Chainlink Surges to $13.5, Breaking Key Resistance Level

Chainlink (LINK) Performance Overview

Chainlink (LINK) has increased significantly, surpassing the $13 resistance level and achieving a 35% gain. This breakout is notable as LINK had struggled around this price since late July. Analysts are optimistic about further upward movement due to shifting market sentiment.

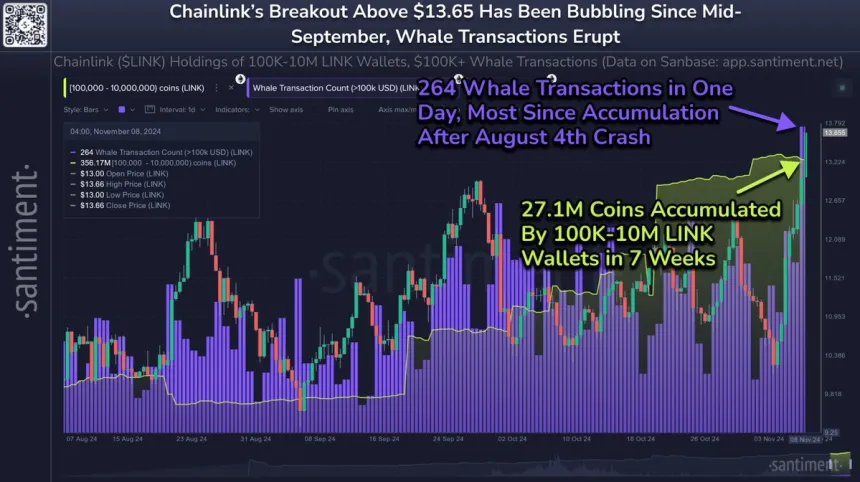

On-chain analytics from Santiment indicates that LINK whale activity has reached a three-month high, with large holders accumulating substantial amounts of LINK. This trend often reflects confidence among major investors, suggesting that Chainlink's recent surge may initiate a more sustained rally.

Chainlink Whales Waking Up

Chainlink's price has surged past critical resistance levels, marking a significant change in its price trajectory. For the first time since July, LINK has broken above $13.65, coinciding with indicators signaling a bullish outlook for the asset.

Santiment reports that Chainlink has decoupled from the broader altcoin market, demonstrating unique performance. Whale activity has spiked, with stakeholders holding between 100K to 10M LINK accumulating $369.8 million worth of the token in seven weeks, representing an 8.2% increase in their holdings.

This increase in whale activity typically indicates confidence in future price potential, with large investors preparing for growth.

The accumulation by Chainlink whales and the breaking of key resistance levels suggest LINK is set for continued growth. As the overall market recovers, Chainlink’s distinct performance could position it as a leader in the altcoin sector. Recent price movements and whale behavior indicate that LINK might sustain bullish momentum.

LINK Testing New Supply

Currently trading at $13.5, Chainlink has successfully surpassed the 200-day moving average (MA) at $12.9, indicating a strong long-term bullish outlook. Maintaining the 200-day MA as support is essential for continuing the uptrend, as it often signifies a transition from bear to bull phases.

While LINK shows strength above $13, a retracement to around $12.5 could provide necessary support for further gains. Such a pullback would allow bulls to consolidate their position for the next upward move.

Traders are targeting $14.5 as the next significant supply zone, where LINK may encounter resistance. If LINK surpasses this level, it could signal strong demand and pave the way for higher prices in the upcoming weeks, supported by whale activity and favorable market sentiment.

Featured image from Dall-E, chart from TradingView