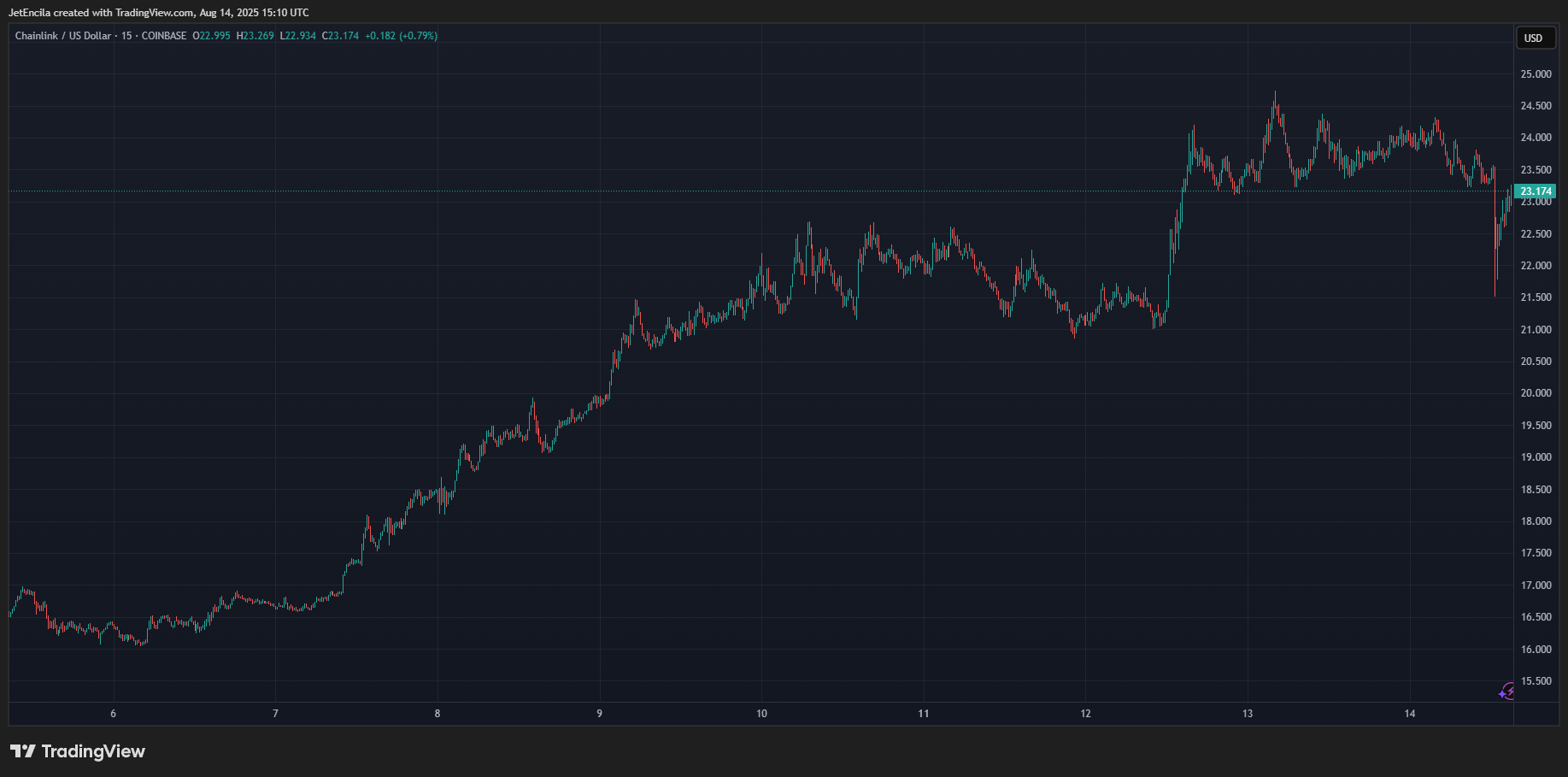

Chainlink Reaches Three-Month High of $23.80 with Increased Trading Volume

Chainlink reached a three-month high of $23.80 this week, driven by strong community sentiment and increased trading activity of approximately $2 billion in the last 24 hours. Key factors include:

- Increased bullish discussions among Chainlink's community.

- A reported buyback of roughly 40,000 LINK units via Uniswap V3.

- Notable upswing in sentiment trackers and consecutive days of price increases.

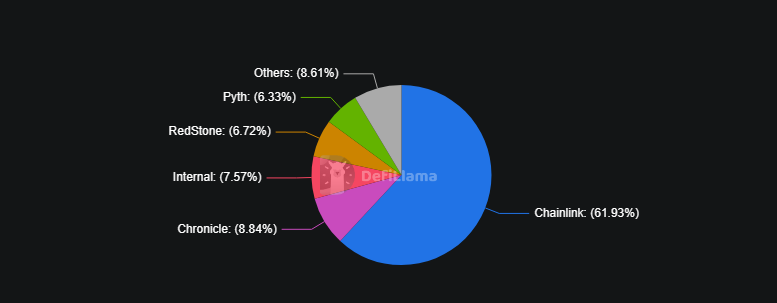

Chainlink secures over $62 billion in total value through its oracle feeds, representing about 60% of the oracle market. It supports data for 450 projects across 21 chains, with nearly $16 billion linked to real-world assets (RWAs) in a $57 billion RWA market. The project was cited in recent White House digital asset frameworks, enhancing its visibility.

Short-term forecasts suggest LINK could increase by 7% to reach $25 by September 13, 2025. Current market indicators show a Bullish sentiment, with the Fear & Greed Index at 75 (Greed). Over the past month, LINK recorded 19 out of 30 green days, with price volatility around 10%. Daily active transactions have risen during this rally, despite a relatively low number of holders.