16 2

Chainlink Surges 10% Amid Whale Accumulation and Market Rally

Chainlink’s LINK Surges Amid Whale Accumulation

- LINK's price increased by nearly 10% in the last 24 hours, with trading volume doubling.

- 30 wallets have withdrawn 6.25 million LINK tokens since October 11, totaling $116.7 million.

- This marks one of the largest accumulation events since early 2023.

- Analysts note significant whale activity and personal increases in LINK holdings.

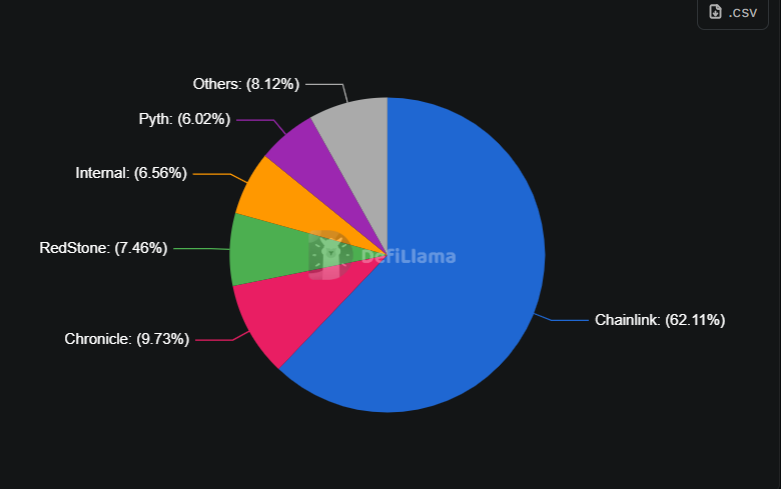

Partnerships and Market Dominance

- Chainlink dominates the oracle space, securing 475 protocols with over $62 billion in total value secured (TVS), accounting for 62% of the market.

- Strategic partnerships with Swift and DTCC aim to bridge traditional finance with blockchain.

- Collaboration with the U.S. Department of Commerce to bring government datasets on-chain strengthens Chainlink’s position in real-world asset tokenization.

Price Outlook

- LINK is currently trading around $18.84, with a market cap of $12.75 billion.

- Bollinger Bands indicate rising volatility; a breakout above $20 could confirm bullish momentum.

- RSI at 45 suggests neutral-to-bullish momentum; failing to hold above 40 may trigger profit-taking.

- LINK has broken its bearish trendline on the 4-hour chart; sustained closing above $17.5 might lead to a retest of the $20 zone.