1 0

BEARISH 📉 : China Tightens Stance On RWA Tokenization Amid Capital Flight Concerns

- China is increasing scrutiny on public tokenization of Real World Assets (RWA) to prevent capital flight, favoring state-run blockchains over open crypto networks.

- This regulatory approach necessitates permissionless interoperability solutions to unify global liquidity beyond restrictive jurisdictions.

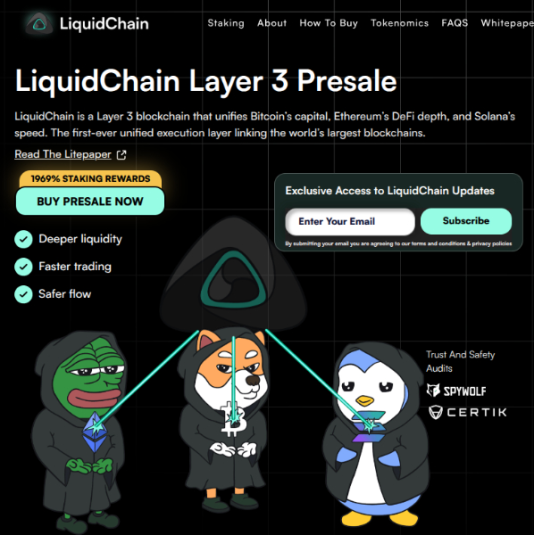

- LiquidChain addresses this by integrating [Bitcoin](https://holder.io/coins/btc/), [Ethereum](https://holder.io/coins/eth/), and Solana into a single execution layer, allowing developers to deploy once for access across different chains.

- LiquidChain's presale has raised over $530K at $0.01355, indicating strong market demand for infrastructure that resolves cross-chain friction.

China's regulatory stance creates a divide between its permissioned blockchain network and the open crypto economy. This fragmentation requires infrastructure that can unify liquidity outside restrictive areas.

Unified L3 Architecture

- The market moves towards Layer 3 infrastructure as connective tissue to solve fragmentation and improve efficiency.

- LiquidChain provides a 'Cross-Chain Liquidity Layer' using a Cross-Chain VM to merge execution environments, reducing complexity for developers.

- This architecture allows Bitcoin to serve as liquidity for applications on other chains like Solana without complex transitions.

Despite regulatory uncertainty, LiquidChain's ongoing presale success signals investor confidence in cross-chain interoperability solutions. The protocol aims to become the default routing layer for next-generation DeFi.