5 0

Circle Valuation Nears $100 Amid Crypto Sentiment Recovery

- Circle is nearing a potential $100 valuation, indicating a recovery in crypto sentiment and increased activity in USDC. This reflects stronger demand for regulated on-chain liquidity.

- Investors are shifting capital from infrastructure equities and large caps to earlier-stage narratives with higher upside potential as risk appetite returns.

- AI-powered content platforms aim to address issues in Web2 creator spaces, such as high fees, opaque moderation, fragmented tools, and limited payment options.

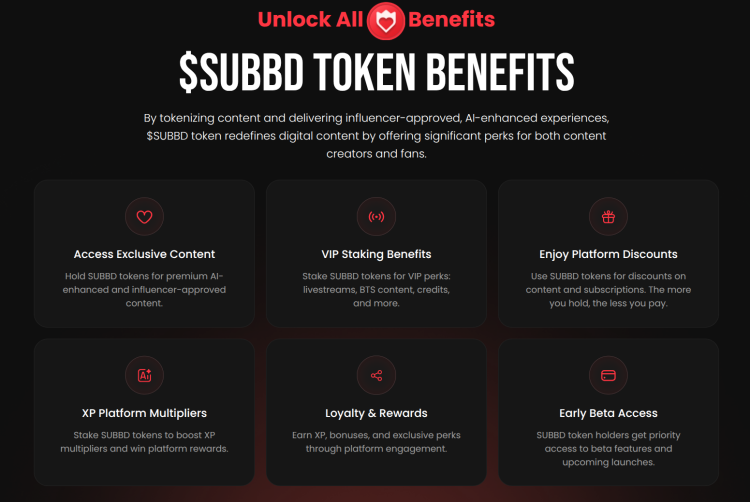

- The SUBBD Token integrates Web3 payments and AI tools to help creators retain more earnings and automate fan engagement within a transparent ecosystem.

Market Dynamics and Shifts

- Circle's valuation serves as a barometer for the crypto market's recovery post-risk-off period.

- On-chain activity and stablecoin usage, especially USDC, are normalizing, suggesting renewed interest in compliant capital movement across exchanges and DeFi.

- Capital is rotating towards sectors with real-world demand, including AI-augmented creator tools and tokenized media platforms.

SUBBD Token's Market Position

- SUBBD Token combines Web3 and AI to offer an integrated platform for creators, addressing high fees and fragmented tools in Web2.

- Its Ethereum-based ecosystem includes AI assistants, voice cloning, token-gated content, and NFT sales.

- Economics focus on reducing platform fees, offering global access, and enabling on-chain governance.

Circle's rise may indicate the beginning of a new crypto cycle, with regulated infrastructure potentially benefiting first. As market confidence returns, investors might explore opportunities like SUBBD Token that capitalize on AI-driven engagement and user-owned economics.