BULLISH 📈 : CIRO’s New Rules Boost Institutional Crypto While LiquidChain Bridges Gaps

- CIRO has established interim custody regulations for Canadian crypto platforms with stricter capital requirements and defined custodial locations to mitigate counterparty risk.

- The new framework aims to facilitate institutional participation by setting clear rules for where and how crypto assets should be held.

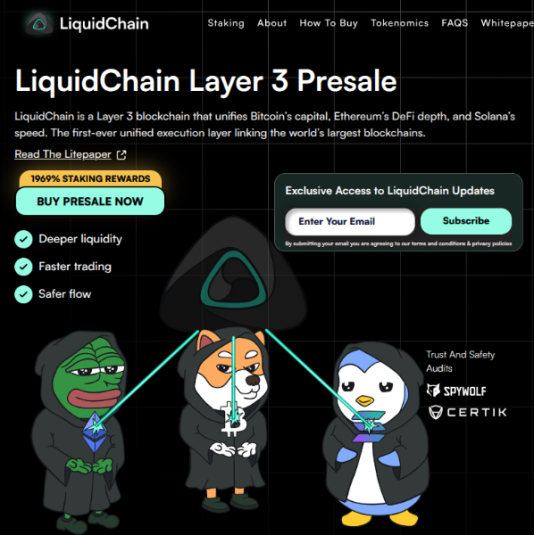

- LiquidChain introduces a Layer 3 infrastructure that consolidates liquidity from Bitcoin, Ethereum, and Solana into a unified environment, addressing market fragmentation issues.

- The 'Deploy-Once' architecture enables developers to create cross-chain applications without managing multiple codebases, simplifying the development process.

The Canadian Investment Regulatory Organization (CIRO) is moving towards institutional-grade custody standards for crypto asset trading platforms, reducing risks highlighted by past exchange collapses. These regulations aim at attracting traditional finance (TradFi) institutions to the crypto sector.

However, as regulatory frameworks tighten, technical challenges like liquidity fragmentation emerge. LiquidChain's Layer 3 protocol seeks to address this by creating a single execution layer across major blockchains, thus enhancing capital efficiency and enabling seamless transactions between $BTC, $ETH, and $SOL ecosystems.

With the 'Deploy-Once' architecture, LiquidChain simplifies institutional access by allowing developers to write logic once for all supported chains. This innovation could lower entry barriers for compliant exchanges under CIRO’s guidelines and promote deeper liquidity integration across blockchain networks.