CME Gap Signals Potential Bitcoin Drop to $77,000 According to Analysts

Concerns have been raised by analysts regarding a potential crash in Bitcoin, which may be influenced by the Chicago Mercantile Exchange (CME) gap. This gap could drive Bitcoin's price down to approximately $77,000 per coin.

Bitcoin Could Slide To $77,000

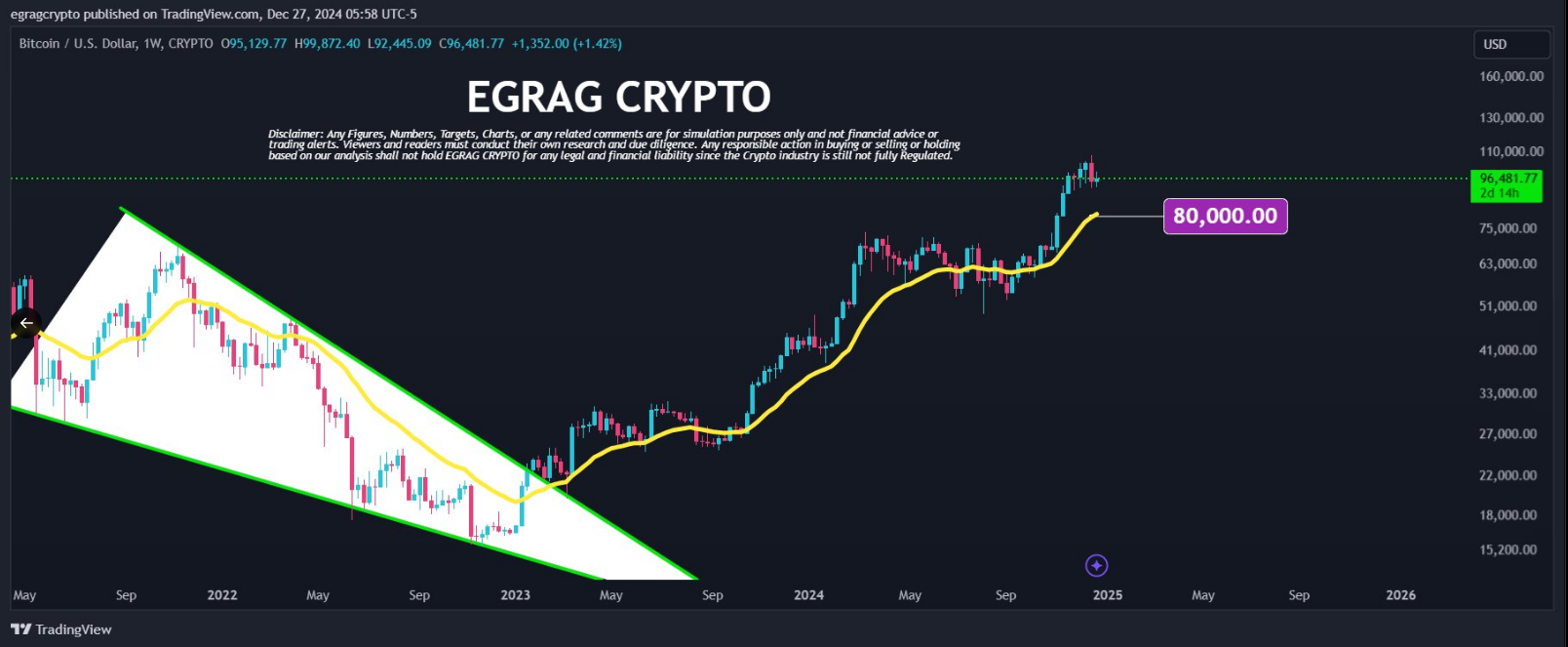

Crypto analyst Egrag Crypto suggests that ongoing corrections may lead Bitcoin to fall to the $77,000 mark. Since October 2022, Bitcoin has experienced seven significant drops, with an average decline of about 23.53%.

#BTC Drop – Average Dump & CME (70K-74K): How & Why?

1⃣Average Drop:

1) 22.70%

2) 20.18%

3) 21.70%

4) 21.42%

5) 23.27%

6) 25.82%

7) 29.65%

The average drop across… pic.twitter.com/Vz6QiZlnzF

— EGRAG CRYPTO (@egragcrypto) December 27, 2024

Egrag noted that from the current high of around 108,975, Bitcoin could potentially drop to the lower end of the CME gap between $77,000 and $80,000, indicating a 25% decline consistent with historical averages.

The current 21 Weekly EMA is approximately $80,000, suggesting a possible flash crash ahead.

CME Gap At $80,000

XForceGlobal highlighted a 1D CME gap at $80,000, noting that historically, 90% of daily CME gaps larger than $1,000 have been filled since 2018.

Just a friendly reminder: there’s a 1D CME gap at $80,000.

Statistically, since 2018, with the growing interest in gaps, 90% of 1-Day timeframe gaps larger than $1,000 have eventually been filled.

The tricky part with CME gaps is… pic.twitter.com/wJC2ih5U8M

— XForceGlobal (@XForceGlobal) December 24, 2024

However, predicting the timing and method for filling CME gaps remains challenging. XForceGlobal outlined two scenarios for filling these gaps, one involving a wave correction that could bring Bitcoin to the $77,000 to $80,000 level and another suggesting a later fill via a 1-2 correction that might see Bitcoin drop to $46,000.

A Market Dump In January?

Egrag speculated that market makers could leverage the upcoming inauguration of President-elect Donald Trump on January 20, 2025, to initiate selling pressure on Bitcoin, potentially leading to a crash.

He proposed two scenarios: one where Bitcoin rises to $120,000 before dropping to the CME gap, and another where it declines to the CME gap of $70,000 to $75,000 before resuming a bull run.

Featured image from Pexels, chart from TradingView