Coinbase CEO Recommends 50% Bitcoin, 35% Ethereum, 15% Solana Allocation

This is a segment from the Empire newsletter.

Trump’s win could influence trading strategies as US regulators may adopt a more favorable stance towards crypto innovation.

The topic of risk appetite was discussed in a recent Empire podcast episode. Yano asked Eric Peters, CEO and CIO of Coinbase Asset Management and One River, about investment advice for a 30-40-year-old first-time crypto investor with a million dollars to allocate and a strong risk appetite.

Peters recommended an allocation of approximately 50% in Bitcoin, 35% in Ether, and 15% in Solana. He noted that if the trade performs well, the investor might wish they had allocated more to Solana.

To evaluate Peters’ suggestion, it can be backtested against Coinbase’s benchmark crypto index COIN50, which is currently allocated 51.5% to BTC, 23.4% to ETH, and 7% to SOL, with the remaining 18% across other altcoins including DOGE, XRP, BCH, and BONK.

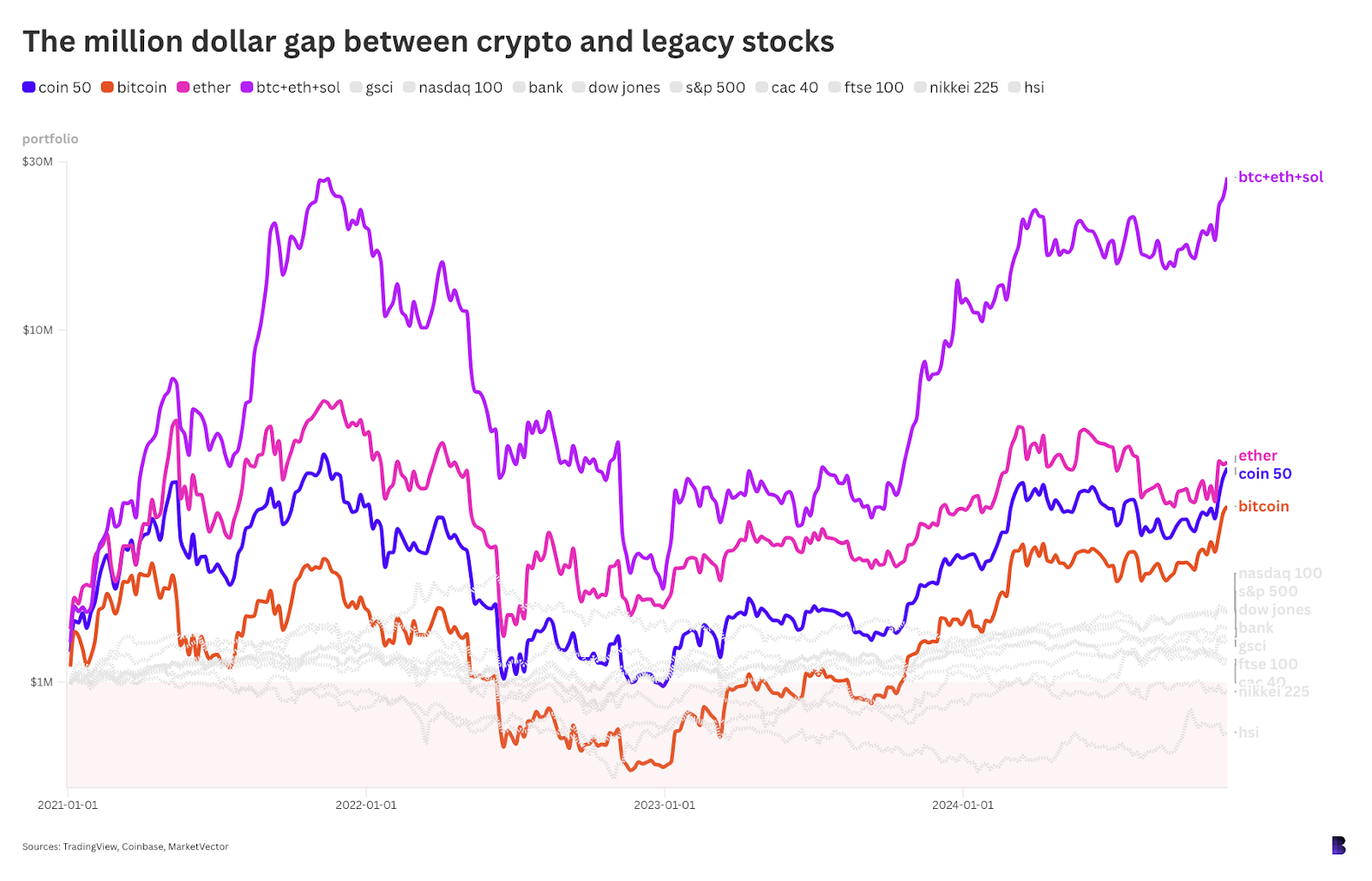

The chart illustrates the performance of a $1 million investment from the end of 2020, coinciding with COIN50’s data inception. The analysis shows SOL's rapid growth, with its market cap increasing from under $100 million to $117 billion.

The purple line represents Peters' suggested allocation, which would have turned $1 million into $27 million. In comparison, an ETH-only strategy would yield $4.2 million, while a hypothetical COIN50 fund would amount to $3.8 million. A $1 million investment solely in BTC would now be worth $3.15 million.

For context, an index fund tracking major benchmarks like the Nasdaq 100 would result in a maximum of $1.64 million, highlighting a $1.5 million difference between stocks and crypto. This difference reflects the potential value of varying risk appetites.