Updated 25 December

Coinbase CEO and Crypto Leaders Gain Billions Post-Election

This article is the third in a series examining the crypto industry's political strategies for the 2024 elections. The first installment covered Fairshake PAC's electoral results, while the second discussed its use of a Supreme Court ruling from 2010.

Financial Impact of Political Contributions

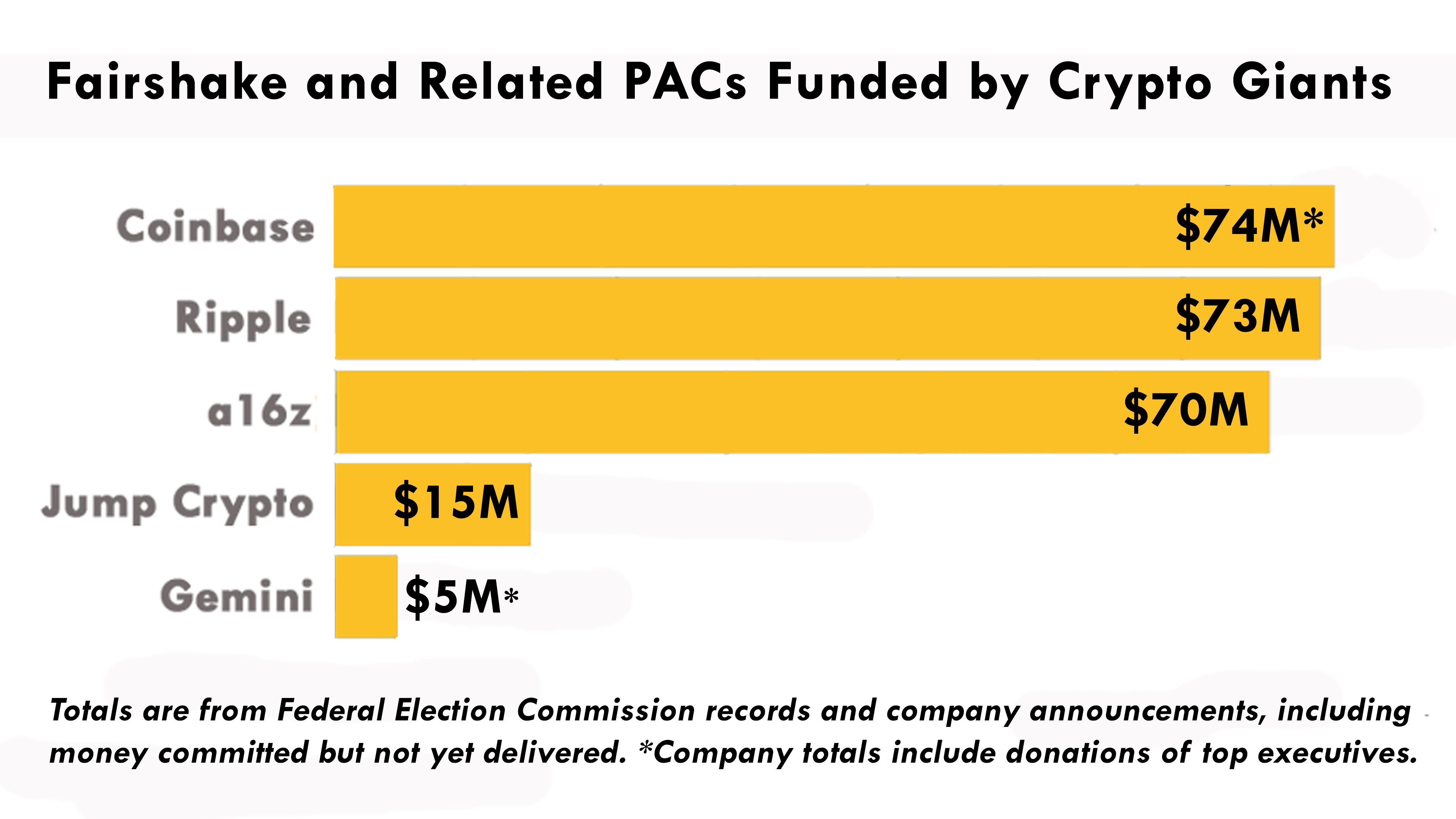

Crypto company leaders have significantly increased their personal wealth following last month's elections, outpacing their contributions to pro-crypto candidates. Coinbase Inc. CEO Brian Armstrong contributed approximately $74 million to Fairshake PAC, which has led to a substantial increase in his company's value by $21 billion since November 4, 2023.

Armstrong's Stock Sales

Shortly after the election, Armstrong executed a pre-planned series of trades, selling $100 million worth of Coinbase shares, which had previously been valued at $39 million less. In total, he sold about $437 million in stock that was worth $308 million before the elections. He still retains over 10% of Coinbase, with 24 million shares valued at approximately $6.4 billion—up nearly $2 billion since November 5.

Other Major Contributors

Ripple Labs CEO Brad Garlinghouse and Andreessen Horowitz (a16z) also made significant contributions, with Ripple donating $73 million and a16z contributing $70 million. Garlinghouse's stake in XRP surged as its price rose from $0.50 to $2.32 post-election, further increasing his personal wealth. Meanwhile, a16z's portfolio includes numerous crypto investments that have gained value following the election.

Political Strategy and Influence

Fairshake PAC emerged as a powerful force in the 2024 elections, supporting 53 congressional candidates. Although it did not participate in the presidential race, the PAC's influence on congressional outcomes was acknowledged by industry leaders. Garlinghouse noted the crypto sector's support for Trump and the resulting market boost.

Crypto Industry's Transactional Approach

The crypto industry faced criticism for its transactional approach to politics, investing heavily to secure favorable legislation. Critics pointed out that this strategy primarily serves the interests of the industry rather than grassroots movements. However, proponents argue that such investments often yield positive returns.

Future Prospects

With the election outcome favoring pro-crypto lawmakers, industry leaders anticipate a more favorable regulatory environment. Cameron Winklevoss expressed optimism about the potential for growth without the burden of legal battles with the SEC. Following the election, Bitcoin reached significant milestones, reinforcing the industry's bullish outlook.