5 0

Coinbase Predicts Crypto Recovery in December Amid Improved Liquidity

Coinbase Research Report Highlights

- Coinbase released a report highlighting improved global liquidity at the start of December.

- The probability of a Federal Reserve rate cut rose to 92% by December 4, potentially boosting risk assets.

- A reversal in market trends is expected in December following weaker performance in November.

Federal Reserve Policy Impact

- The Fed's involvement in the bond market may signal the end of quantitative tightening, reducing liquidity pressure.

- Bitcoin fell over three standard deviations below its 90-day trend in November, indicating undervaluation.

- Long-term holders distributed coins, and digital asset products traded below net asset value for the first time this year, suggesting a potential recovery.

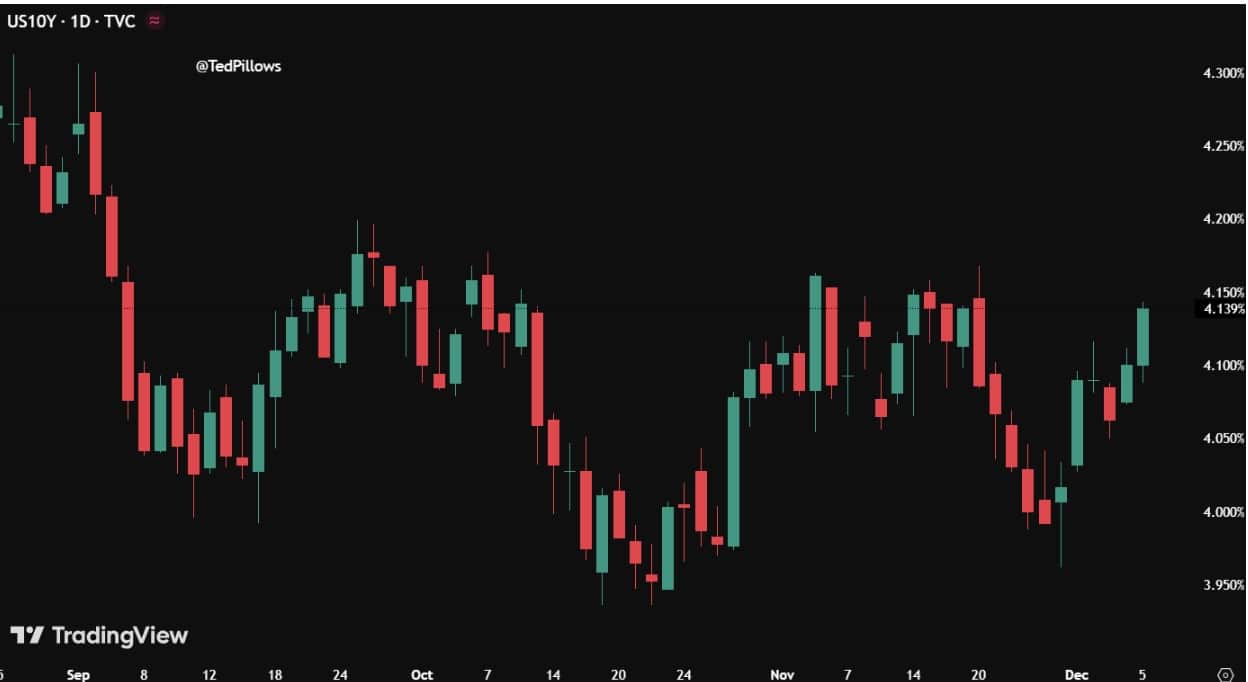

- US 10-year bond yield experienced a significant increase, posing challenges for risk-on assets.

Altcoin and Stablecoin Signals

- Divergence observed between stablecoin dominance and altcoin performance.

- Stablecoin strength showed signs of fatigue, while altcoins remained steady.

- If Bitcoin stabilizes, capital may rotate back to altcoins, which could accelerate as liquidity shifts towards higher-risk assets.