Crypto Market Crash Highlights Liquidity Issues and $BEST’s Investment Potential

The October 10 crypto crash highlighted weaknesses in major liquidity providers, as noted by Tom Lee from BitMine. A rapid selloff wiped out nearly $20 billion, causing over-leveraged market makers to unwind positions quickly. This led to a liquidity vacuum, widening spreads, and accelerating the crash.

Liquidity Crunch Impact

- Market makers with leveraged books became forced sellers during the crash.

- Liquidity evaporated, slippage increased, and execution quality dropped.

- Smaller tokens and venues became untradeable for hours.

Diversified Wallet Strategies

- MetaMask: Focuses on smarter routing and institutional integrations.

- Trust Wallet: Emphasizes simplicity and broad asset support.

- Phantom: Expanded to EVM chains for multichain retail flow.

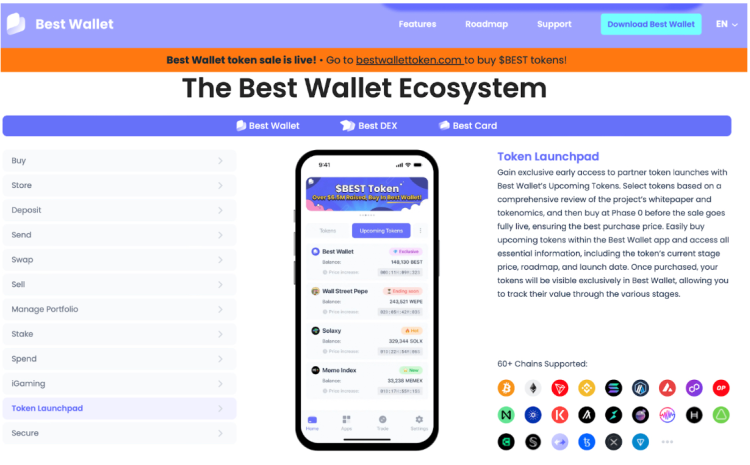

Best Wallet aims to differentiate itself by offering a mobile-first, non-custodial ecosystem designed to maintain user control even during volatile times. It is targeting 40% of the global wallet market by 2026, focusing on institutional-grade security within a consumer-friendly interface.

- Utilizes Fireblocks MPC-CMP infrastructure to enhance security.

- Offers a multi-wallet portfolio system for different investment strategies.

- Includes features like the Upcoming Tokens portal and Best DEX aggregator.

The presale of $BEST tokens has raised over $17.2 million, with tokens priced at $0.025975. Features include reduced in-app fees and staking opportunities for holders.

This strategic response to market volatility emphasizes flexible, fee-efficient, and self-custodial solutions.