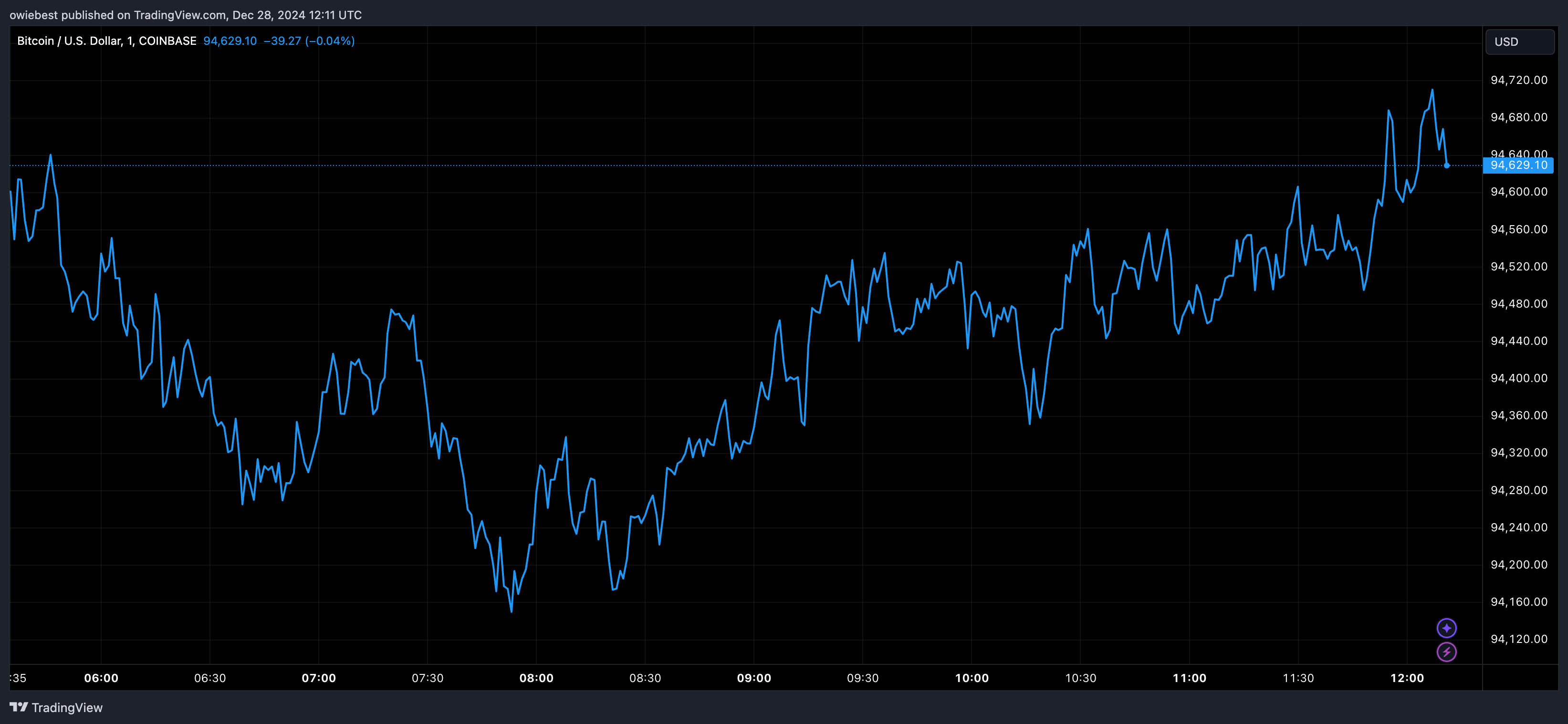

Crypto Market Maintains Greed Sentiment Amid Bitcoin Price Drop to $94,000

The cryptocurrency market exhibits confidence despite Bitcoin's significant drop to $94,000. Predictions from analysts on social media and TradingView reflect optimism across various cryptocurrencies. The Crypto Market Fear and Greed Index indicates greed, suggesting a temporary dip before a broader recovery.

Bitcoin Price Crash Stalls Bullish Momentum

The crypto industry has shown bullish momentum in 2024, with many cryptocurrencies reaching multi-year highs. Bitcoin initially broke its 2021 all-time high of $69,000 and surpassed the $100,000 psychological level on December 5. However, since then, Bitcoin's price action has been characterized by corrections. It peaked at $108,135 on December 17 but fell as low as $92,600 recently, causing declines among other cryptocurrencies and stalling bullish momentum.

This correction is attributed to profit-taking by long-term holders and a temporary slowdown in market activity.

Crypto Market Sentiment Stays In Greed

Despite recent declines, HODLing trends indicate that the market remains poised for a rally into 2025. The Fear and Greed Index remains in the greed zone, currently at a reading of 72, reflecting investor confidence. This index combines metrics such as market volatility, trading volume, social media sentiment, Bitcoin dominance, Google search trends, and surveys to gauge the market's psychological state.

Recent buying trends support this sentiment, with on-chain data showing Dogecoin whales purchased over 90 million DOGE tokens in 48 hours. Analysts predict a broader market recovery if Bitcoin maintains support above $92,000.

Currently, Bitcoin trades at $94,400, down 12.8% from its peak of $108,135. Analyst Ali Martinez notes that corrections between 20% and 30% are common in Bitcoin's bull cycles.