Crypto Liquidity Engine Reaches $300 Billion Following Terra Collapse

If crypto were an ocean, Terra was a whirlpool. When that Maelstrom collapsed in May 2022, it pulled liquidity from crypto markets for a year.

At that time, stablecoins served as the primary liquidity source, leading to significant market withdrawals. Tether experienced a month-long $16 billion “bank run” on USDT, while Circle burned over $30 billion USDC between June 2022 and November 2023. Paxos wound down Binance's BUSD, redeeming about $20 billion worth of stablecoins over 12 months, coinciding with Bitcoin's resurgence in late 2023.

Liquid staking and restaking tokens likely helped maintain liquidity during this turmoil, as liquidations, bankruptcies, and fraud cases unfolded.

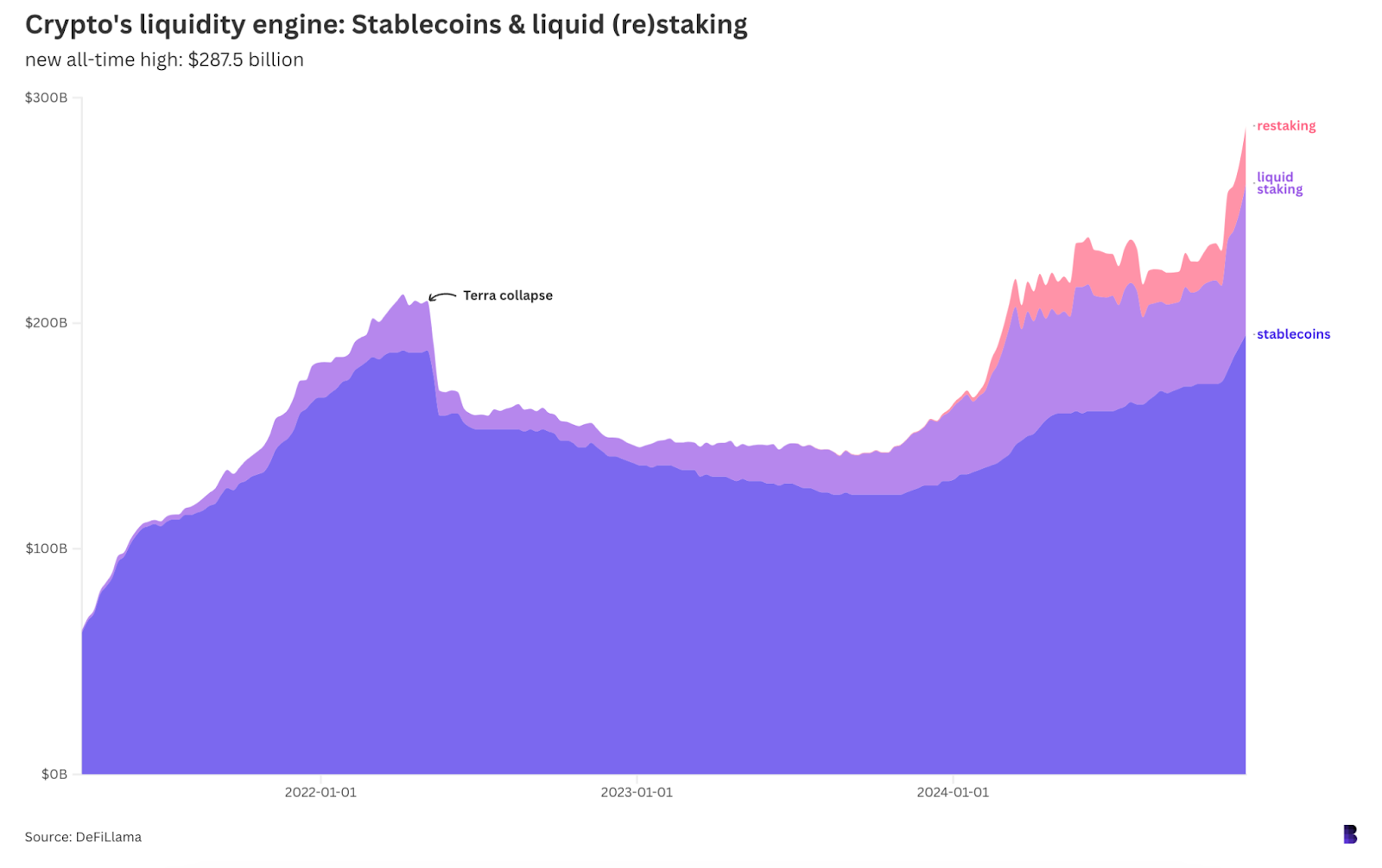

This chart shows the market cap of stablecoins (blue) alongside liquid staking (purple) and restaking (pink) tokens since Q1 2021. Together, these token classes form what is termed crypto’s liquidity engine.

As billions drained from crypto through stablecoin redemptions, liquid staking tokens expanded to counterbalance those losses, stabilizing crypto’s liquidity for about 10 months. Liquid (re)staking tokens surged when stablecoin redemption trends reversed.

Currently, Terra is a minor event in crypto history. Stablecoin supplies have reached a new all-time high of nearly $194 billion, surpassing levels before Terra's collapse, while liquid staking and restaking tokens have also achieved a combined peak of $92.5 billion. This results in a total liquidity engine of nearly $300 billion, with no significant disruptions anticipated.