Crypto Market Loses $770 Million as Solana and Dogecoin Drop Over 10%

Bullish positions in cryptocurrencies incurred losses of $770 million within 24 hours as bitcoin fell below $100,000. Major cryptocurrencies experienced significant declines:

- Solana (SOL) and Dogecoin (DOGE) dropped over 10%

- Ethereum (ETH), BNB Chain's BNB, XRP, and Cardano (ADA) decreased by up to 9%

The overall market cap declined by 8.5%. Tokens outside the top twenty also suffered, with losses reaching up to 18% for memecoin Pepe (PEPE), Aptos (APT), Gate.io’s GATE, and Virtuals (VIRTUALS).

Jupiter's JUP was an exception, gaining 3.5% due to a buyback decision from generated fees, potentially resulting in hundreds of millions in net buying volumes annually.

Bitcoin traded under $99,000 as traders took profits ahead of the U.S. FOMC meeting. This drop mirrored losses in U.S. stock futures influenced by concerns over China-based DeepSeek's capabilities.

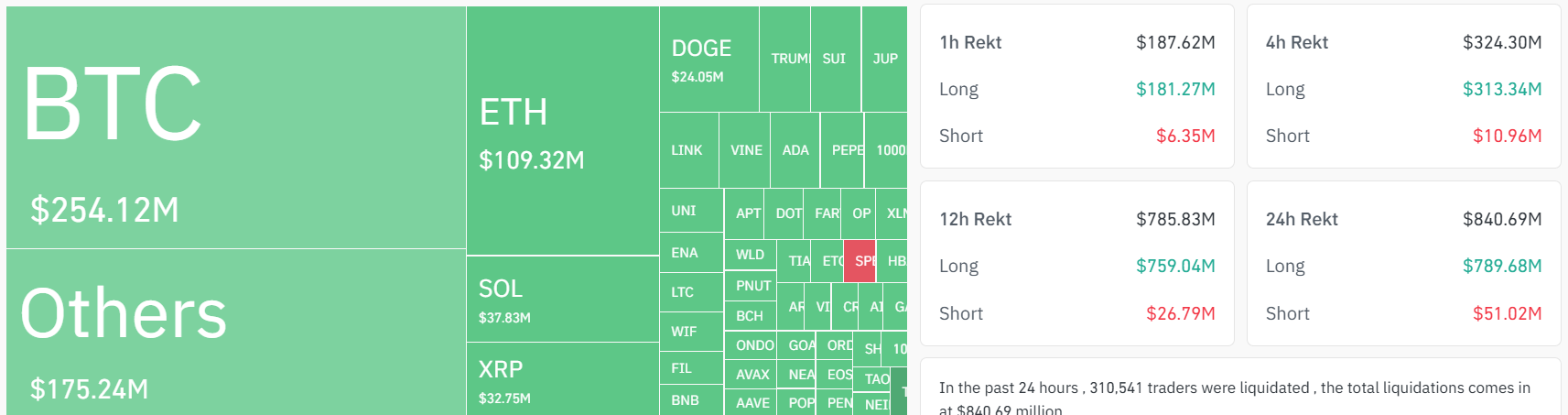

Futures markets reflected these declines with significant losses:

- $238 million lost in BTC-tracked products

- $50 million lost in SOL and DOGE bets

- $138 million lost in altcoin-tracked products

- $84 million lost in ether-tracked futures

The largest liquidation order was valued at $98.4 million on HTX for a tether-margined BTC trade. Liquidations indicate insufficient funds for leveraged trades, common during high volatility periods. They can signal market corrections or act as support/resistance levels. Continued declines may encourage short positions, while contrarian traders might see heavy liquidations as buying opportunities.