5 1

Crypto Markets Misprice Potential Trump-Influenced Fed Rate Cuts

Crypto markets are adjusting to potential changes in US monetary policy, with macro trader Alex Krüger highlighting a possible mispricing of future rate cuts under a Trump-aligned Federal Reserve leadership.

Fed Cut Mispricing and Crypto Impact

- Alex Krüger notes that futures curves do not fully account for what might happen if a Trump-associated Fed Chair is appointed post-Powell's term in May 2026.

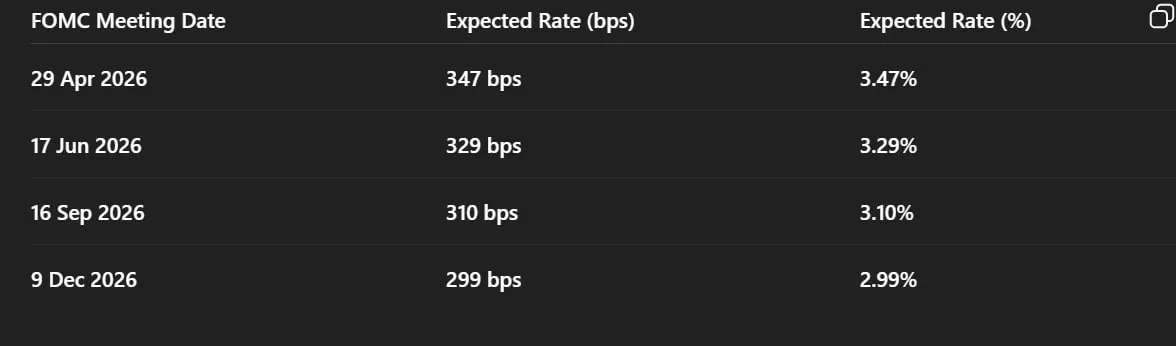

- The CME-derived table suggests a gradual reduction in the fed funds rate from 3.47% in April 2026 to 2.99% by December 2026.

- Krüger argues this path does not reflect the faster pace of cuts favored by some Trump-aligned advisors, such as Fed Governor Stephen Miran, who prefers quicker rates of around 2% to 2.5%.

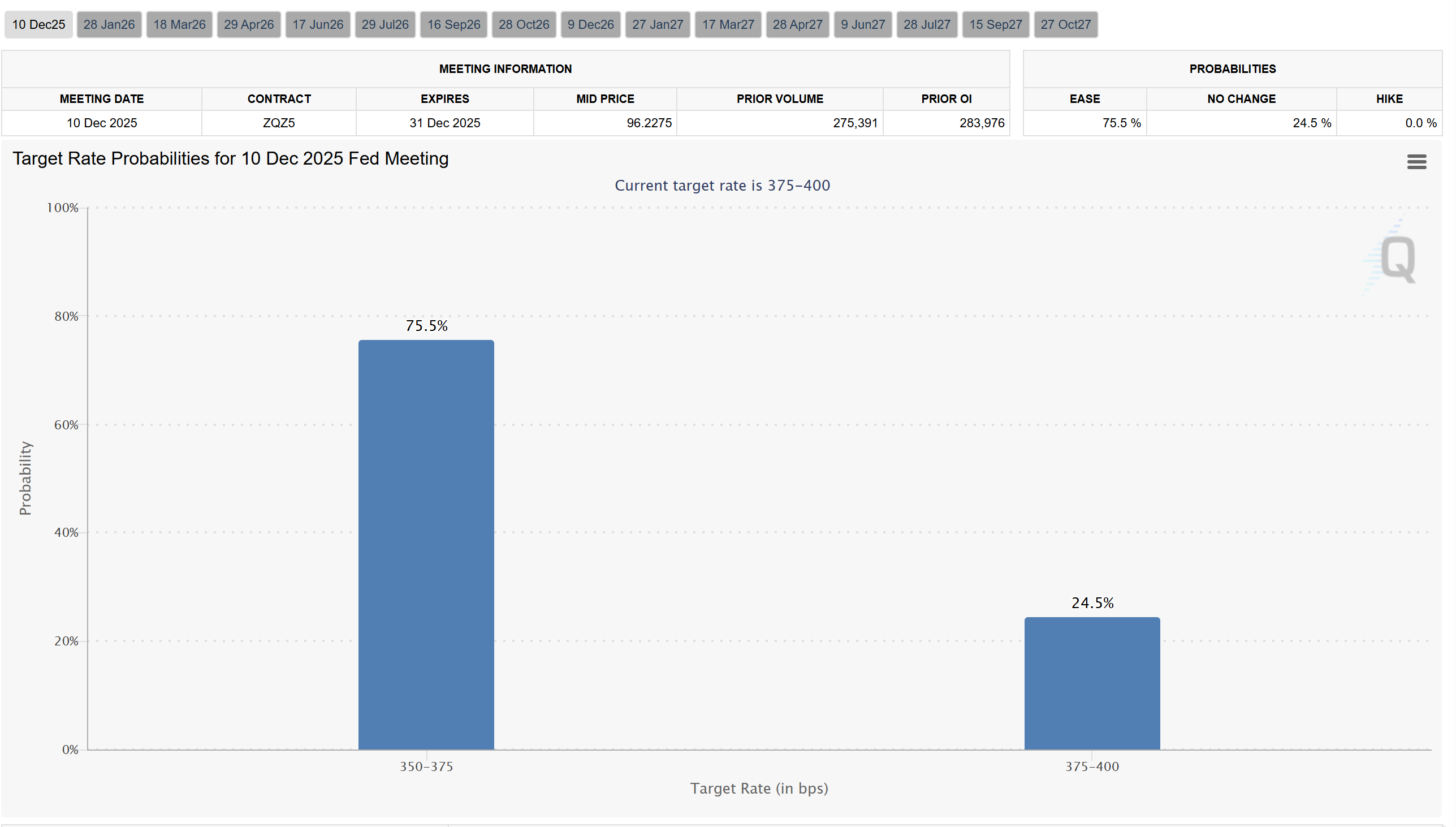

December Rate Cut Likelihood

- Traders have increased the likelihood of a rate cut at the December Fed meeting, influenced by comments from New York Fed President John Williams.

- Goldman Sachs anticipates rate cuts in December 2025, March, and June 2026, bringing the rate to between 3.00% and 3.25%.

- Krüger warns that current market expectations might underestimate the potential for more aggressive easing under a new Fed chair.

For crypto investors, the key issue is the speed and extent of the Fed's rate cuts. If Krüger's scenario unfolds, implying larger and quicker cuts, crypto markets may face another round of valuation adjustments due to shifts in dollar liquidity and interest rate expectations.

At present, the total crypto market cap stands at $2.92 trillion.