Crypto Trader Earns Over $17 Million from AI Tokens and Moves to Memecoins

A crypto trader focused on artificial intelligence (AI) projects has reportedly earned over $17 million from various AI tokens, with on-chain data indicating a shift towards new memecoins. An analysis by Lookonchain on X highlights that the trader's largest profits originated from early investments in GOAT, ai16z, Fartcoin, and ARC.

Crypto Trader Turns AI Coins Into $17 Million

Lookonchain stated that the trader made profits exceeding $5.14 million from GOAT, over $4.5 million from ai16z, approximately $4 million from Fartcoin, and around $4 million from ARC. The analysis suggests an exploration of new token acquisitions.

The trader's most significant gain came from GOAT. He purchased around 11.1 million GOAT tokens for about $62,000 when its market cap was under $2 million. After selling all tokens, he realized approximately $5.2 million, netting around $5.14 million.

His performance with ai16z, a decentralized AI trading fund on Solana, is notable. He invested $123,000 to acquire 6.17 million tokens at a market cap of $22 million. Lookonchain reports he sold 4.67 million ai16z tokens at approximately $1.78 each and retains 2.65 million tokens valued at near $2.9 million, totaling over $4.5 million in profit.

Significant gains were also reported from Fartcoin, where the trader invested $121,000 to purchase around 9.46 million tokens at a market cap below $7 million. He sold 6.81 million tokens for $610,000 and holds 2.65 million tokens valued at $3.55 million, resulting in a net profit of roughly $4 million.

A similar trend was observed with ARC, where he invested $212,000 to acquire 11.6 million tokens at a market cap of about $15 million. After selling 1.6 million tokens for the same amount he invested, he currently holds 10 million tokens worth around $4 million, yielding another $4 million profit.

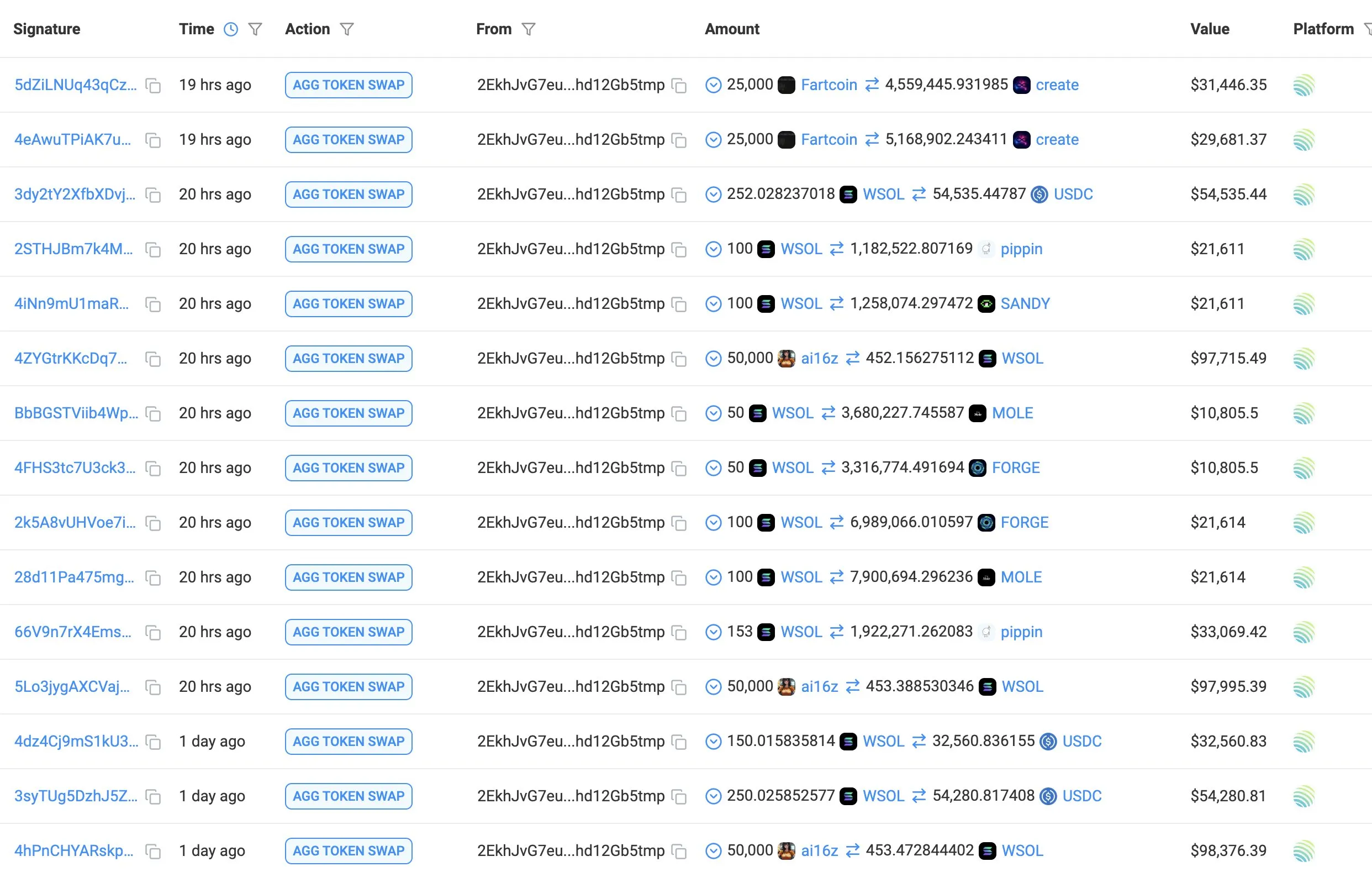

Lookonchain’s analysis also mentions the trader's recent investments in smaller-cap memecoins like CREATE, PIPPIN, SANDY, MOLE, and FORGE. A screenshot indicates part of these investments was financed by selling Fartcoin in two transactions for $31,446.35 and $29,681.37. Additional capital was generated from selling Wrapped SOL (WSOL) in multiple transactions, including 100 units for $21,611, 50 units for $10,805.50, and 153 units for $33,069.42.

The WSOL sales indicate a strategic approach to liquidity management before investing in CREATE, PIPPIN, SANDY, MOLE, and FORGE. In total, he allocated $202,255 for these memecoins, with expenditures of $61,127 on CREATE, $21,611 on PIPPIN, $21,611 on SANDY, $65,486 on MOLE, and $32,420 on FORGE.

At press time, GOAT traded at $0.52.