13 March 2025

2 0

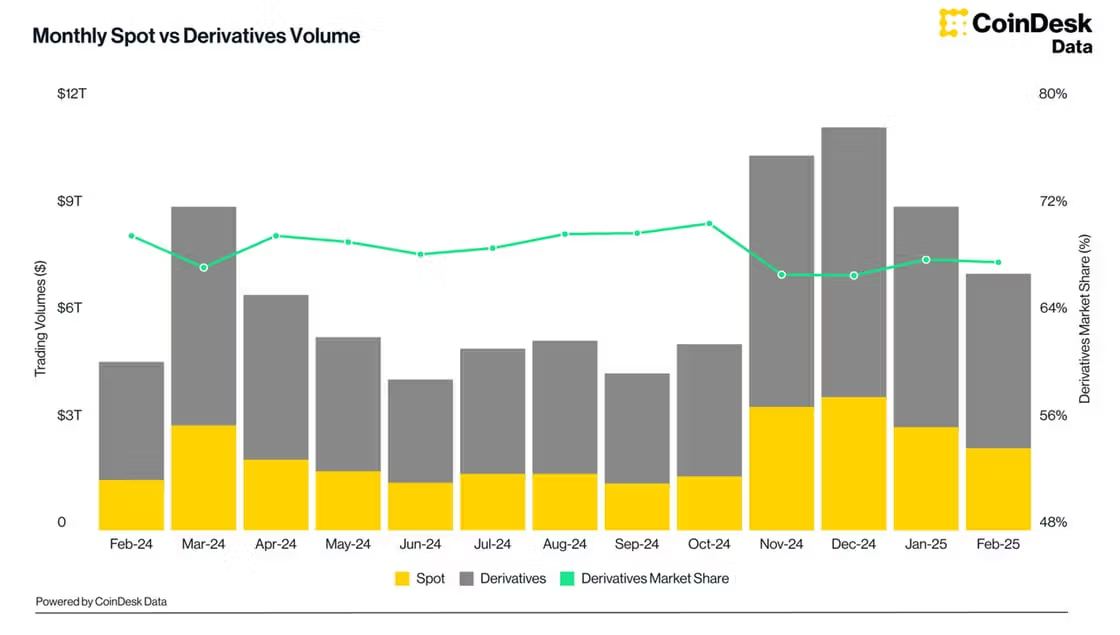

Crypto Trading Volumes Decline 21% to $7.2 Trillion in February

Crypto trading volumes experienced a significant decline in February, impacted by concerns over President Trump's tariffs on international trade. Key points include:

- Combined spot and derivatives trading volume on centralized exchanges fell 21% to $7.2 trillion, the lowest since October.

- Binance led as the largest spot trading platform with a 27% market share, followed by Crypto.com (8.1%) and Bybit (7.4%).

- CME reported its first volume drop in five months, with total trading down 20% to $229 billion; bitcoin futures declined by 20% and ether futures by 13%.

- The BTC CME annualized basis dropped to 4.08%, while CME's market share among derivatives exchanges rose to a record 4.67%.

- Total open interest across trading pairs on centralized exchanges decreased by 30% to $78.8 billion, reflecting significant liquidations.

Despite a decline in retail trading activity, institutional interest remains steady.