7 0

Crypto Treasury Stocks Fall Post-Investment, Highlighting PEPENODE Presale

Recent announcements of new crypto investments have led to a decline in stock values for several companies.

- Helius Medical Technologies invested $175.6M in 760,190 [Solana](https://holder.io/coins/sol/) ($SOL) at $231 each, resulting in a 33.61% stock decline to $16.02.

- CEA Industries, supported by former Binance CEO Changpeng Zhao, announced a $500M investment in [Binance Coin](https://holder.io/coins/bnb/) ($BNB), causing a 19.5% stock drop to $7.80.

- BitMine Immersion Technologies disclosed holding over 2% of [Ethereum](https://holder.io/coins/eth/) tokens, leading to a 10% stock decrease.

Despite these setbacks, the market shows resilience:

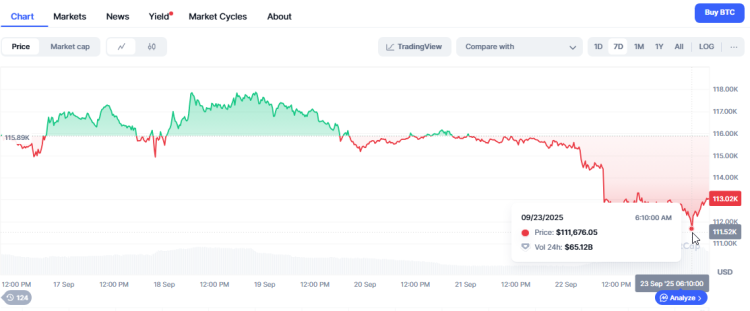

- Strategy acquired 850 [Bitcoin](https://holder.io/coins/btc/) ($BTC) for $99.7M, raising its reserves to 639,835 coins. This came after Bitcoin's price fell 5.23% to $111,676 following a Federal Reserve rate cut.

- Bitcoin has since partially recovered, trading above $113k.

- HashKey Capital CEO, Deng Chao, remains optimistic about crypto treasuries with long-term strategies.

The market anticipates further developments as the Fed plans more rate cuts this year, potentially impacting cryptocurrency prices.

This summary is based on recent market developments and is not financial advice.