Updated 21 December

Analysts Predict Promising Trends in Crypto Market for 2024

If we aim to celebrate Christmas, some green is needed to balance the red this morning.

Kraken’s Thomas Perfumo warned last week about potential pullbacks ahead of the holidays, which appears to be occurring now. The effectiveness of any selling counteractions remains uncertain.

This discussion will not focus on current market actions.

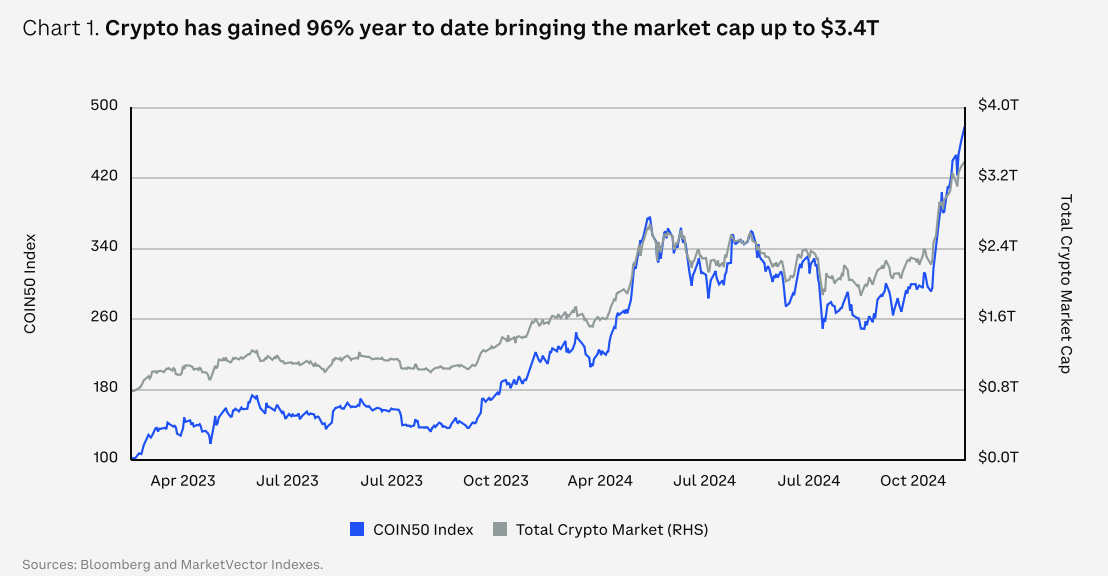

Earlier this week, Coinbase Institutional released its market outlook for next year. David Duong, head of research, noted that the 2024 uptrend shows significant differences from previous cycles, yet the overall landscape remains promising.

VanEck predicts that the bull market will continue into next year, potentially peaking at $180,000 for bitcoin. They anticipate a subsequent 30% retracement, with altcoins possibly experiencing double that decline. A recovery is expected in the fall, with major tokens regaining momentum and reaching previous all-time highs by year-end.

Despite potential declines, Coinbase Institutional maintains a bullish outlook. Duong stated that as regulatory and technological landscapes evolve, substantial growth in the crypto ecosystem is anticipated, driven by wider adoption. This year may be pivotal, with advancements in 2025 shaping the long-term trajectory of the industry.

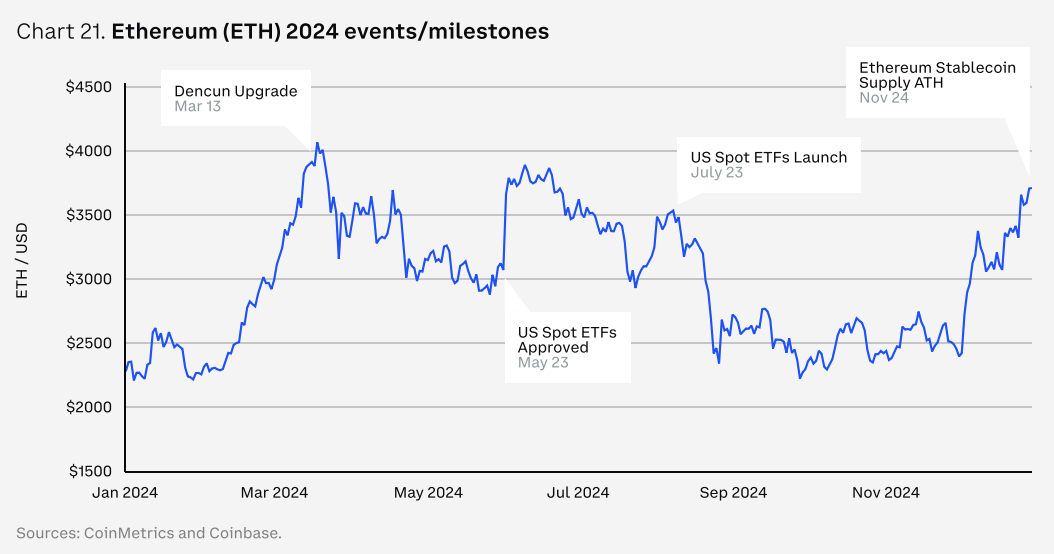

A question posed to several individuals is whether ETH can make a comeback next year. ETH has lagged behind while bitcoin and Solana reach new all-time highs.

Duong and his team believe the growth of the Ethereum L2 ecosystem is beneficial, but it is unclear if this will support ETH in the short to medium term. According to 21Shares, Solana is likely to continue gaining market share from Ethereum due to improved user experience and infrastructure, without anticipating a full "flippening." They also suggest that Ethereum may experience a "revenue renaissance" starting next year, as Web2 firms and traditional finance entities launch their own L2 solutions to unlock new revenue streams and meet the growing demand for decentralized applications.

Overall, the outlook suggests potential for positive developments ahead.