Current Bitcoin Hashrate Suggests Market Cap Could Reach $5 Trillion

The founder and CEO of the on-chain analytics firm CryptoQuant has outlined the potential peak market cap for Bitcoin based on current hashrate trends.

Bitcoin Ceiling Based on Network Hashrate

In a recent post on X, Ki Young Ju discussed a BTC pricing model that establishes upper and lower price bounds using mining hashrate trends. The mining hashrate measures the total computing power miners currently use to secure the Bitcoin blockchain.

Miners compete to solve mathematical puzzles, earning block rewards as compensation. The intrinsic value of Bitcoin may be assessed through its hashrate due to the operational costs miners face, including electricity bills.

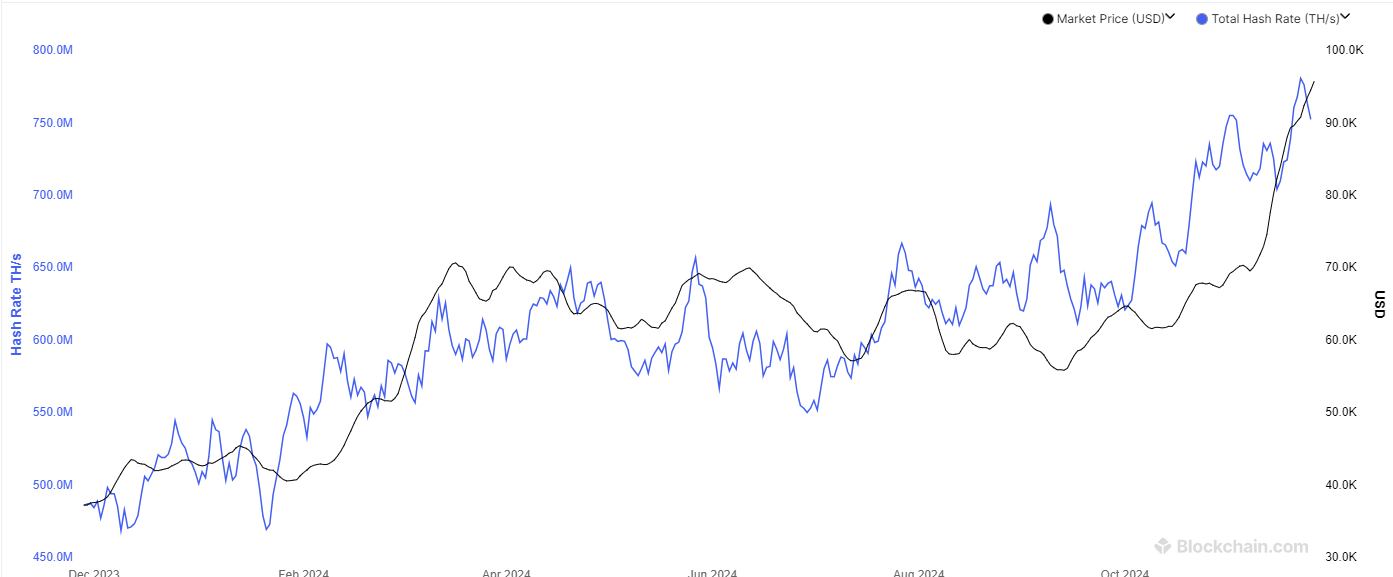

The chart below illustrates a recent rise in BTC mining hashrate, reaching new all-time highs (ATHs).

This uptrend correlates with the asset's rally, as price directly influences miner revenue. The block subsidy received by miners fluctuates with Bitcoin's price.

The BTC network features a Halving event approximately every four years, reducing the block subsidy by half. This process leads to a consistent decline in miner revenue in BTC.

Young Ju's pricing model adjusts for this Halving effect by analyzing the ratio of market cap to adjusted hashrate, determining extreme values for this ratio throughout Bitcoin's history.

The following chart presents the required market cap values for the ratio to match its historical extremes:

The graph indicates that the maximum potential Bitcoin market cap, given the current hashrate, is nearly $5 trillion. Currently, Bitcoin's market cap is just under $1.9 trillion, representing 38% of this upper limit.

Notably, the 2021 bull run peak occurred below the model's top line, suggesting that the current cycle's peak may also not reach it. However, the market cap approached this peak ratio more closely in 2021 than it has thus far in the current cycle, indicating potential for further growth.

Significant drawdowns in the chart correspond to Halving events in 2016, 2020, and 2024, reflecting their economic impacts on Bitcoin mining.

BTC Price

Currently, Bitcoin trades at approximately $94,400, having increased over 2% in the past week.