Curve Finance Proposes $60M Yield Basis for CRV Income Generation

Curve Finance founder Michael Egorov proposed a new protocol, Yield Basis, on the Curve DAO governance forum. This initiative aims to provide CRV token holders with a more direct income stream by distributing sustainable returns through staking and governance participation.

- The proposal includes minting $60 million of Curve’s crvUSD stablecoin before launching Yield Basis.

- Funds from the sale will support three bitcoin-focused pools: WBTC, cbBTC, and tBTC, each capped at $10 million.

- Yield Basis is set to return 35% to 65% of its value to veCRV holders, reserving 25% for the Curve ecosystem.

- Voting on this proposal is scheduled from September 17 to September 24.

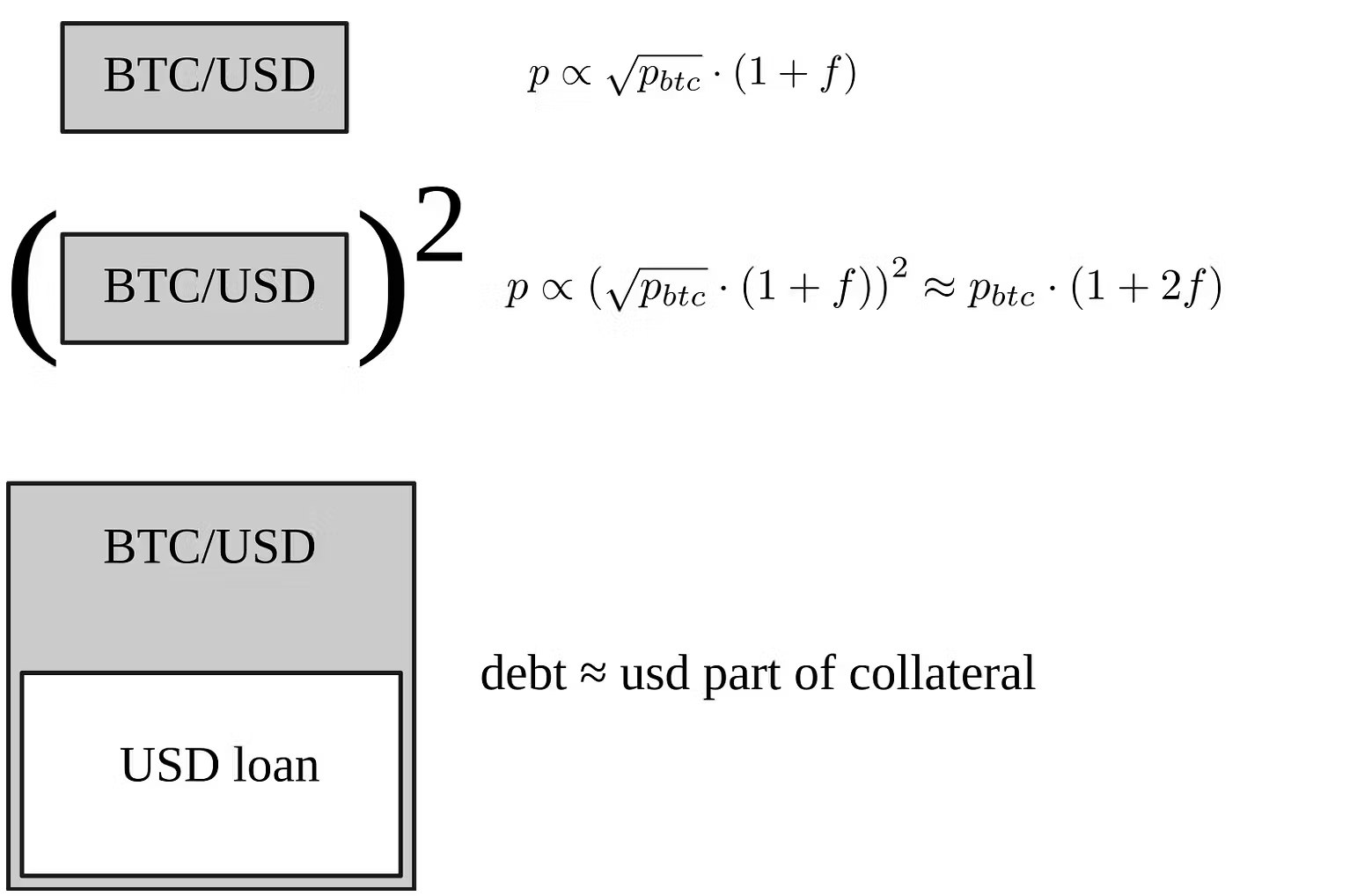

The protocol targets institutional and professional traders by offering transparent, sustainable bitcoin yields while mitigating impermanent loss issues common in automated market makers.

Amidst these developments, Egorov faced financial challenges, including several high-profile liquidations linked to leveraged CRV purchases. Notably, in June, over $140 million worth of CRV positions were liquidated, resulting in $10 million in bad debt for Curve. More recently, in December, he was liquidated for 918,830 CRV (approximately $882,000) after a 12% drop in CRV’s price.

CRV's value increased by about 1% in the past 24 hours.