4 0

CZ and Kiyosaki Advocate Buying Crypto Amid Market Fear

Key Insights on Market Strategy:

- Changpeng Zhao, founder of Binance, advises buying during periods of market fear rather than chasing rallies.

- Robert Kiyosaki highlights risks associated with Japan's carry trade collapse and suggests Bitcoin, Ethereum, gold, and silver as protective assets.

Market Conditions:

- The Fear and Greed Index currently stands at 20, indicating high fear levels in the crypto market.

- Bitcoin's metrics suggest a "quiet equilibrium," signaling a stable phase rather than a breakdown.

Japan’s Carry Trade Impact

- The Bank of Japan's rate hikes have increased government bond yields to levels not seen since 2008, impacting global asset structures.

- This has led to forced liquidations due to increased borrowing costs and declining foreign asset positions.

Bitcoin’s Market Reset

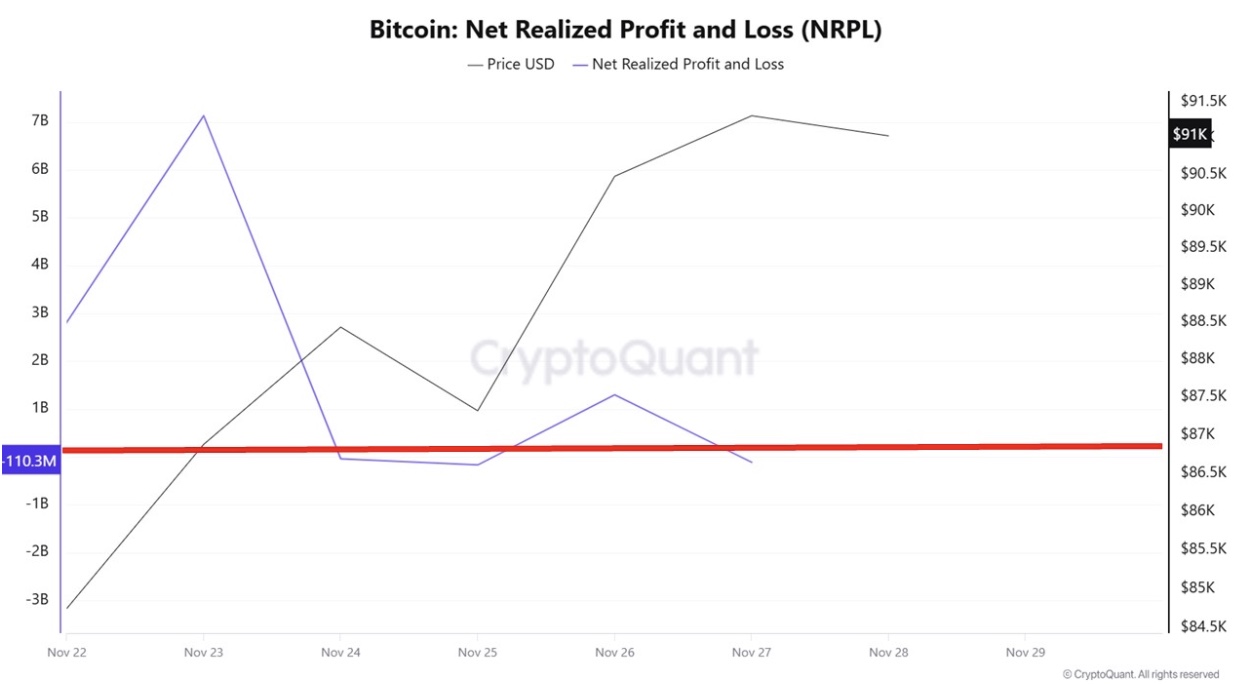

- CryptoQuant notes that Bitcoin’s Net Realized Profit and Loss is stabilizing, indicating a neutral market phase.

- If NRPL remains positive, it could signify a recovery base; a negative dip would indicate weakness.

- The anchored VWAP shows Bitcoin is undervalued, suggesting potential for accumulation.

Investors should monitor these trends as they decide on future investments.