74 0

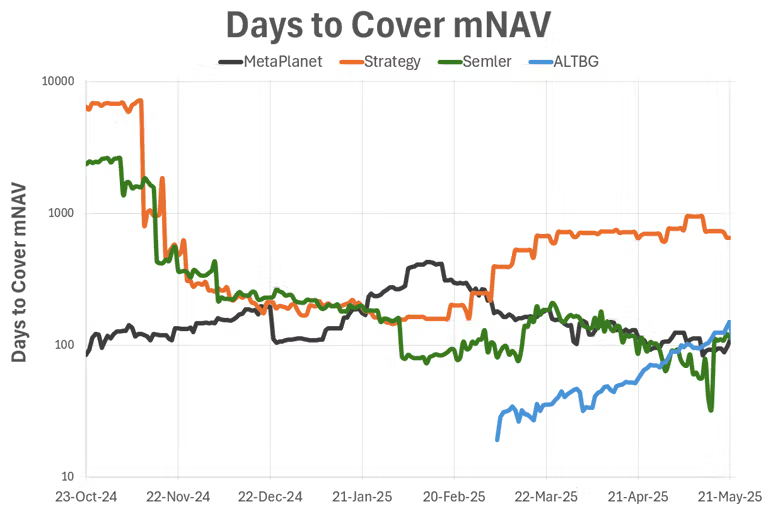

‘Days to Cover mNAV’ Becomes Key Metric for Bitcoin Equity Evaluation

As bitcoin (BTC) solidifies its role as an institutional asset, more public companies are adding BTC to their treasuries. This trend has led to increased interest in leveraged bitcoin equities (LBEs).

Key points include:

- The metric “Days to Cover mNAV” evaluates how long a company needs to accumulate enough BTC to justify its market cap.

- This metric uses the formula: Days to Cover = ln(mNAV) / ln(1 + BTC Yield), accounting for compounding growth.

- Strategy (MSTR) holds an mNAV of 2.1 but has a low daily BTC yield of 0.12%, resulting in 626 days to cover its valuation.

- MetaPlanet (3350) and The Blockchain Group (ALTBG) have higher average BTC yields of near 1.5%, allowing them to support mNAVs of 5.08 and 9.4, with coverage times of just 110 and 152 days, respectively.

- Sembler Scientific (SMLR) shows a competitive 114 Days to Cover with an mNAV of 1.5 and a yield of 0.33%.

- Faster accumulators like MetaPlanet and ALTBG are gaining investor interest due to their ability to enhance valuations through BTC compounding.

Days to Cover mNAV serves as a quantitative tool for assessing long-term sustainability and potential in the crypto investment sector.