11 0

DeFi Sector Achieves 90% Reduction in Exploit Losses Since 2020

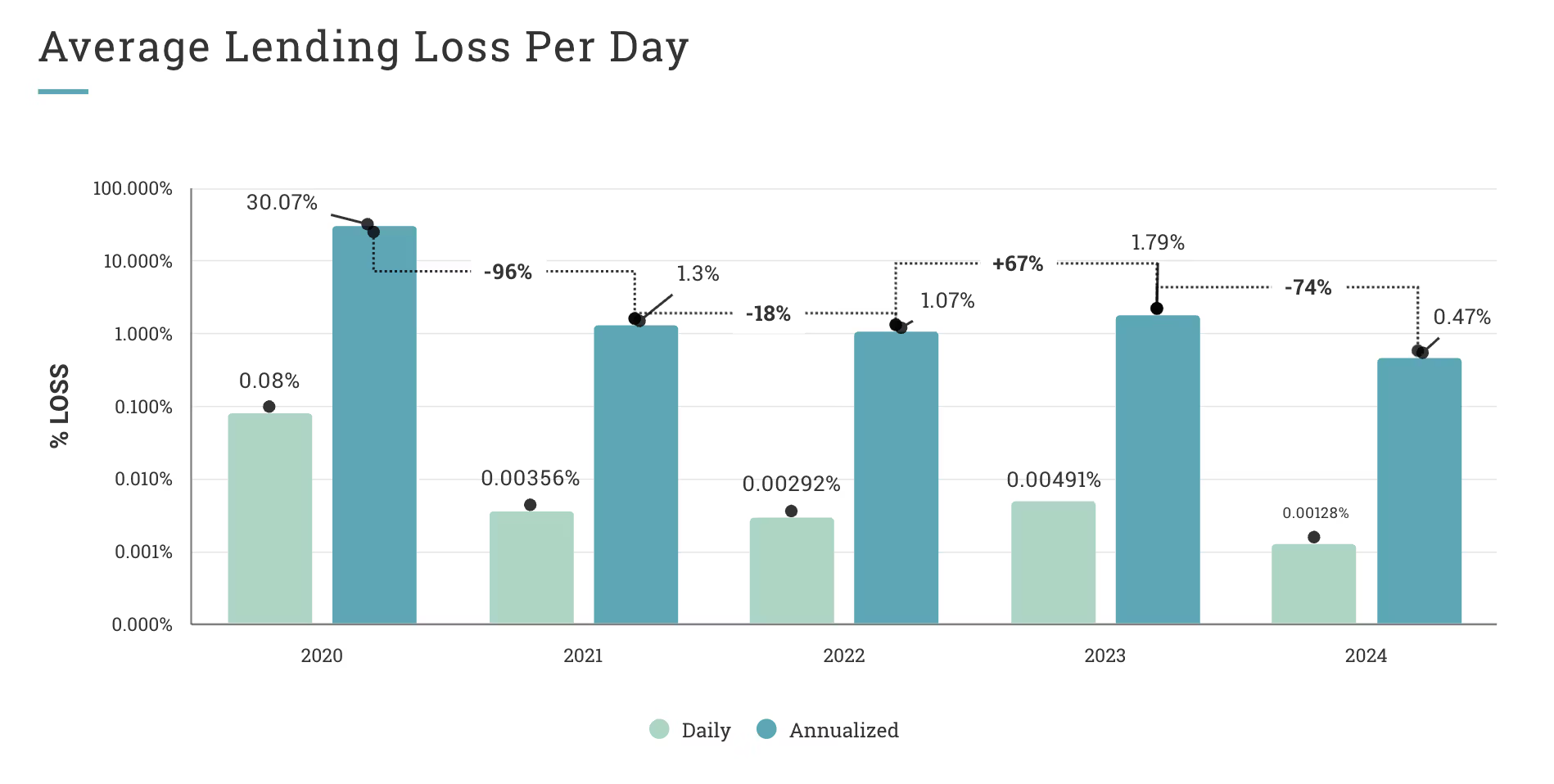

The DeFi sector has achieved a significant security transformation, with a 90% reduction in exploit losses since 2020. By 2024, daily loss rates dropped to 0.0014%, showing its maturity for institutional adoption.

- DeFi protocols have transitioned from an "experimental era" with 30.07% annualized losses in 2020 to a secure infrastructure with just 0.47% losses by 2024.

- Five security phases:

- "Experimental Era" (2020): High losses due to unaudited smart contracts.

- "First Security Revolution" (2021): 96% improvement through audits and bug bounties.

- Optimization plateau (2022) and backslide (2023).

- "Comprehensive Security Achievement" (2024): 74% further loss reduction. - Attack patterns shifted:

- Yield aggregators' attack share dropped from 49% in 2020 to 14% in 2024.

- Trading and AMM platforms became primary targets, rising from 0% to 18%.

- Private key compromises increased from 0% to 20% of incidents.

- The lending sector saw a 98.4% improvement in security, reducing daily loss rates to 0.00128%.

- Improved defenses against vulnerabilities like smart contract issues, flash loan attacks, and governance exploits.

- The Structural Risk Factor (SRF) framework aids in assessing protocol risks for real-world asset applications.

This evolution challenges DeFi risk narratives, proving decentralized protocols can meet or exceed traditional financial security standards. It supports complex decentralized financial products and institutional-scale capital deployment, showcasing community-driven innovation.