113 6

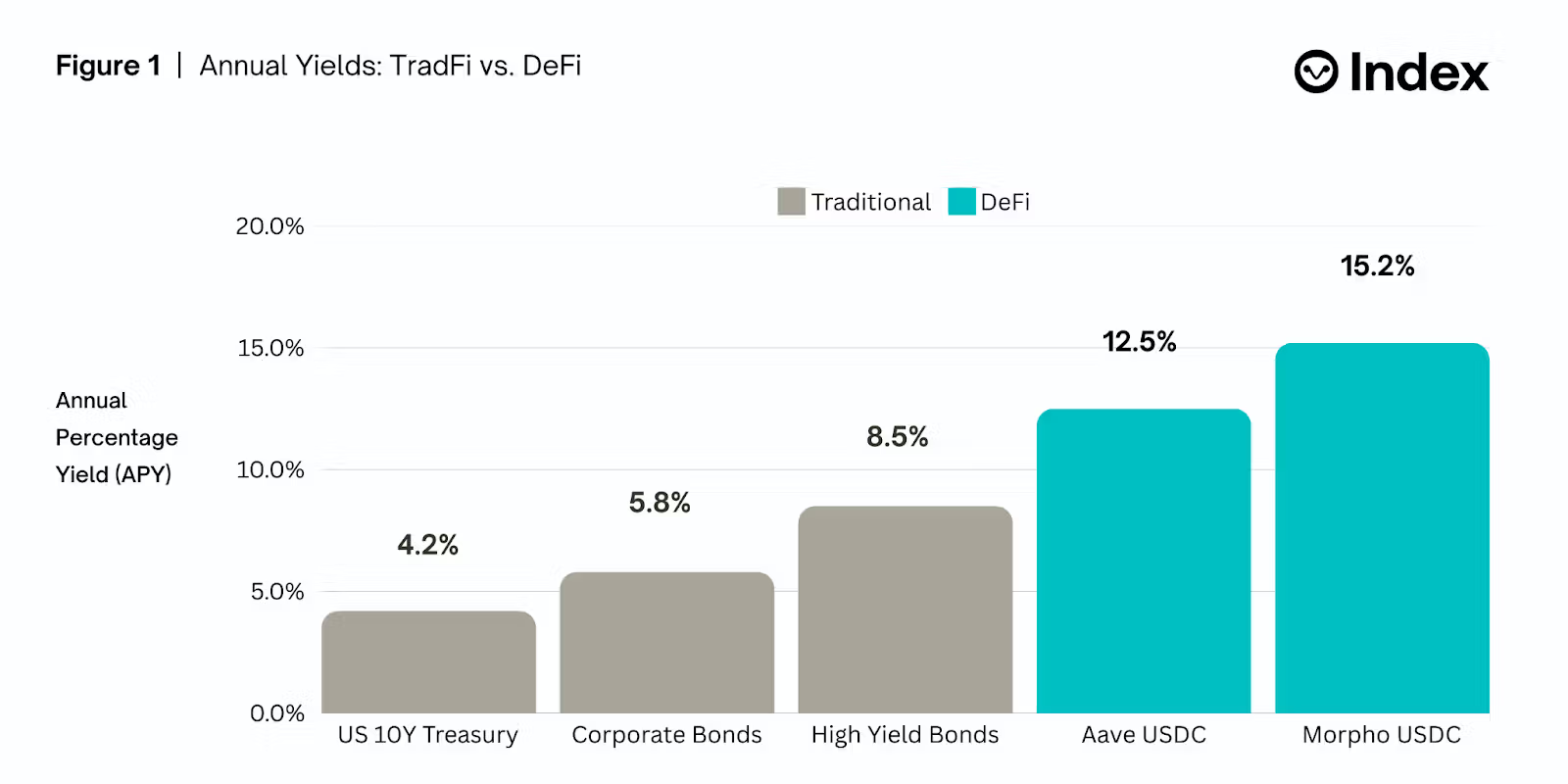

DeFi Platforms Offer Double-Digit Yields on Stablecoin Lending

DeFi has established a new benchmark for lending stablecoins, mirroring the traditional "risk-free rate." Key points include:

- Lenders on platforms like Morpho and Aave can achieve yields of 12-15% APY for USDC, surpassing U.S. Treasuries' 4-5%.

- This shift reflects market-driven demand for stablecoin borrowing, not increased risk.

- High-yield farming strategies, particularly through Ethena’s synthetic dollar (sUSDe), have driven up stablecoin lending rates, reaching 20-30% APY.

- Ethena captures funding fees typically taken by centralized exchanges, benefiting DeFi participants holding sUSDe.

- The demand for sUSDe increases capital in the stablecoin economy, enhancing yield and liquidity in lending markets.

- Leading protocols exhibit resilience against risks like smart contract vulnerabilities and stablecoin depegging through diversification.

- For wealth managers, these developments offer opportunities but also challenges regarding income-focused portfolios.

- As DeFi infrastructure matures, it could redefine standards for transparent, risk-adjusted yields in finance.

Source: Traditional markets data from Bloomberg Terminal, DeFi markets data from vaults.fyi