13 0

DeFi TVL Reaches $170B, Erasing Terra Collapse Losses

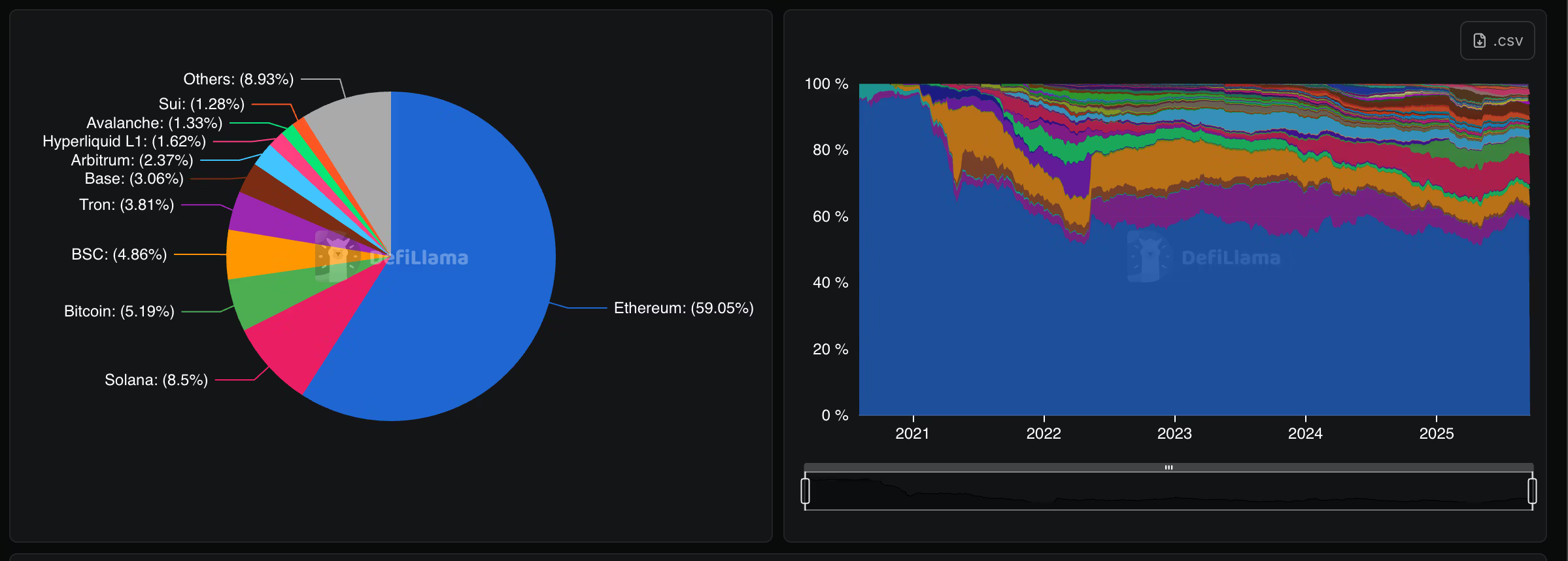

The total capital locked in decentralized finance (DeFi) protocols has reached $170 billion, recovering from the Terra/LUNA collapse and subsequent bear market.

- Ethereum holds 59% of the capital, while emerging networks like Base and Sui collectively hold over $10 billion, around 6%.

- Institutional adoption of ether has led to a shift from traditional staking products to institutional alternatives, with growth also noted in Solana and BNB Chain due to increased memecoin activity.

- Solana is the second-largest blockchain in DeFi with $14.4 billion locked, followed by BNB Chain at $8.2 billion.

The sector has matured post-2022 with more stable yields compared to the unsustainable rates offered during the Terra era. Aave now offers a 5.2% yield on stablecoins, and Ether.fi offers 11.1%.

Despite recovering, DeFi still faces challenges such as hacks and scams, with $2.5 billion lost in the first half of 2025 alone. Security and hack prevention remain crucial for future growth and stability in the sector.