Derivatives Exchanges Receive 82,000 ETH Deposits Indicating Potential Volatility

On-chain data indicates that derivatives exchanges have received significant Ethereum deposits, which could lead to price volatility for ETH.

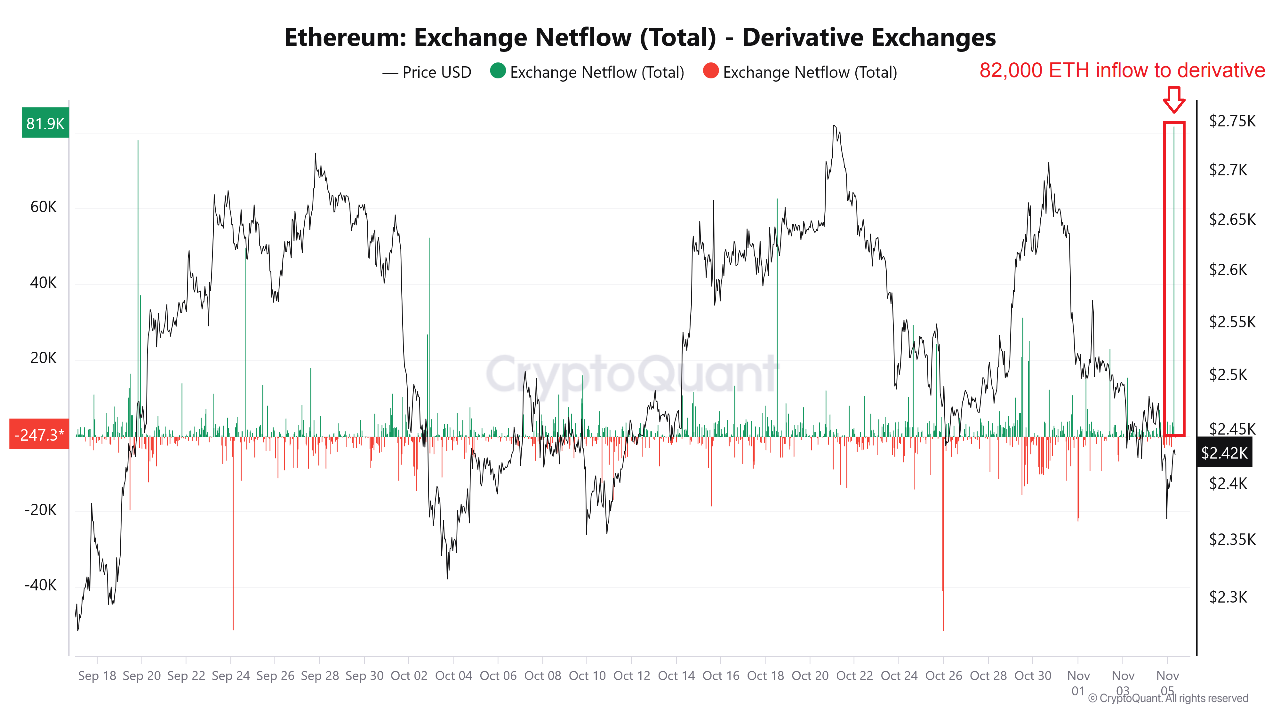

Ethereum Exchange Netflow Shows Positive Spike

Recent analysis from CryptoQuant highlights a notable increase in the Exchange Netflow for ETH, an on-chain indicator tracking the net amount of ETH moving to and from centralized exchange wallets. A positive value indicates a net deposit of tokens to these platforms, impacting ETH based on the type of exchange involved.

In spot exchanges, net deposits typically signify selling intentions, leading to bearish outcomes. Conversely, deposits to derivatives exchanges indicate that holders are opening new positions, often using leverage, thereby increasing risk and potential volatility for ETH's price.

A negative Exchange Netflow generally signals bullish sentiment, as it suggests investors are transferring their coins to self-custodial wallets, indicating long-term holding strategies.

The chart below illustrates the recent trend in Ethereum Exchange Netflow for derivatives platforms:

The graph shows a substantial spike into positive territory, indicating large net deposits of approximately 82,000 ETH to derivatives exchanges, potentially leading to increased volatility.

The direction of this volatility remains uncertain, with previous spikes yielding mixed results. The latest influx coincides with a decline in Ethereum’s price, suggesting many may be taking short positions anticipating further drops. If prices rise, liquidating these positions could catalyze additional upward momentum.

ETH Price

Currently, Ethereum trades at around $2,400, reflecting a nearly 7% decrease over the past week.