Hyperliquid DEX sees recovery as open interest rises despite trading volume dip

In the aftermath of the October 10, 2025 crypto crash, Hyperliquid (HYPE), a major decentralized exchange, faced significant declines as it moved into 2026. A report by GLC highlights these challenges and evaluates its recovery.

Key Metrics Post-Downturn

- Since October 10, trading volume decreased by 44.3%, from $10.17 billion to $5.66 billion.

- Open interest fell by 35.7%, from $14.75 billion to $9.48 billion.

- From December 1, 2025, open interest surged by 45.6% despite a slight 3.2% decrease in trading volume.

Year-to-date statistics show:

- Trading volume increased by 59.2%, reaching $5.66 billion.

- Open interest grew by 24.7%, reaching $9.48 billion.

The volume-to-open interest ratio dropped from 0.90 to 0.60 due to reduced market volatility. However, traders are opening larger positions, indicating potential recovery.

Prospects for 2026

- The 7-day average volume rose over 130% year-to-date, led by active deployer XYZ.

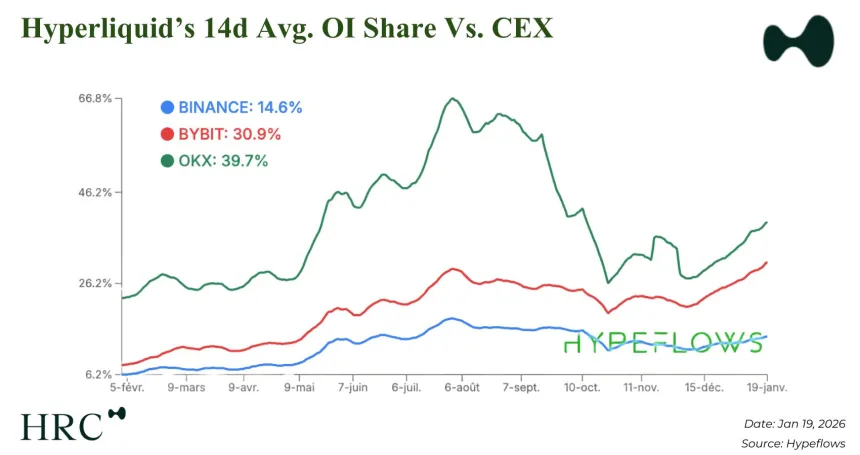

- Open interest increased by over 60%, with Hyperliquid regaining market share from centralized exchanges, representing about 14.6% of Binance's open interest.

Portfolio margin, currently on testnet, could significantly enhance trading volume, following patterns seen in other exchanges like Bybit. This feature allows borrowing and lending against collateral.

GLC suggests that if market conditions improve alongside these catalysts, such as adopting equity perpetuals and portfolio margin, Hyperliquid might see a substantial resurgence.

Presently, HYPE token trades at $21.84, marking a 9% decline in the last 24 hours and 63% below its all-time high of $59.30.