10 0

Digital Yen JPYC EX Launches, Bridging Traditional Finance and DeFi

Japan has launched JPYC EX, its first fully licensed digital yen under the revised Payment Services Act. This marks a significant development in Japan’s financial sector, integrating traditional banking with the Web3 ecosystem.

- JPYC EX is a compliant, yen-backed stablecoin that connects Japan's banking system to blockchain commerce, DeFi applications, and cross-border payments.

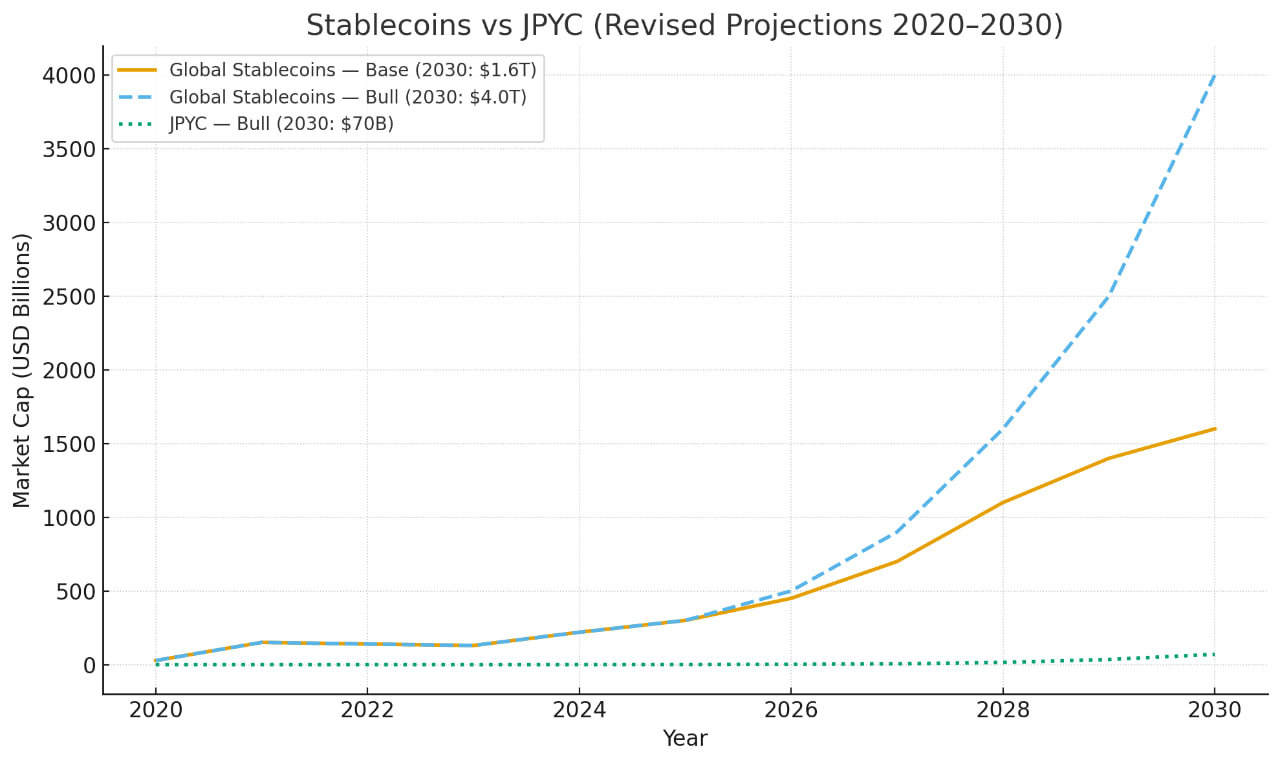

- The total stablecoin market capitalization exceeds $150 billion, with projections suggesting growth to $1.6-$4 trillion by 2030. JPYC could capture about 2%, reaching around $70 billion.

- Each JPYC EX token is fully collateralized by domestic bank deposits and Japanese government bonds, ensuring transparency and stability.

- Built on Ethereum, Polygon, and Avalanche, JPYC EX enables instant yen transfers at near-zero fees, supporting various payment and DeFi applications.

- JPYC aligns with Japan’s digital transformation strategy, facilitating e-commerce, NFT marketplaces, and cross-border transactions in Asia.

- JPYC's potential $70 billion market cap by 2030 underscores Japan’s aim to establish the digital yen as a key player in the decentralized global economy.

Stablecoin Market Trends

- Stablecoin market dominance is currently around 8.31%, after rising above 9% earlier in October, indicating high demand for liquidity amid market uncertainty.

- Dominance climbed from 7.3%–7.5% over recent months, reflecting cautious sentiment as Bitcoin and major altcoins face selling pressure.

- The current level remains above 50-day and 200-day moving averages, suggesting a broader uptrend in liquidity positioning.

- A drop below 8% might indicate capital redeployment into crypto assets, potentially sparking short-term rallies.

- Elevated stablecoin dominance shows a preference for liquidity, highlighting market caution between risk-off sentiment and readiness for re-entry into volatile assets.