Dogecoin Consolidates Above $0.40 as Traders Anticipate New ATH

Dogecoin is currently testing demand above the $0.40 level, following a period of consolidation below its yearly high of $0.484. This phase has created uncertainty among traders, yet market sentiment remains optimistic, with expectations for a potential breakout.

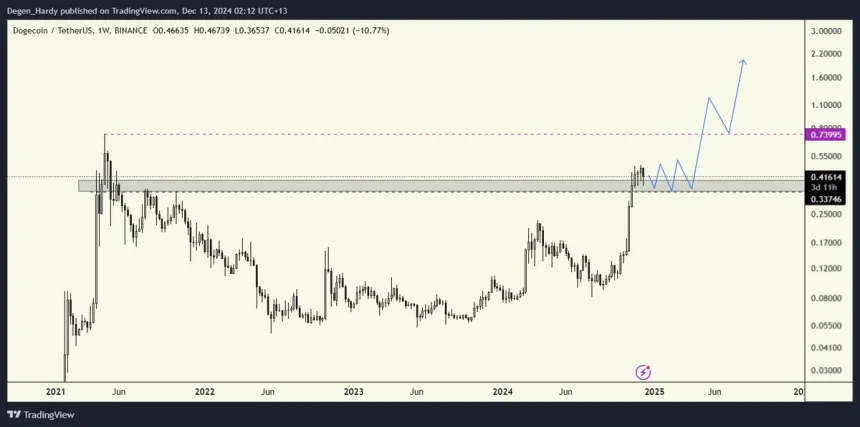

Analyst Hardy provided a technical analysis suggesting that Dogecoin may soon break into new all-time highs. He believes the current consolidation indicates a bullish foundation, increasing the likelihood of significant upward movement.

If Dogecoin maintains support above $0.40, it could trigger a substantial rally in the upcoming weeks. However, broader market conditions and sustained buying pressure will be critical for this scenario. Whale activity and increased trading volumes may facilitate a retest of recent highs.

Dogecoin Consolidation Overview

Dogecoin's price has stabilized below its yearly high of $0.484 after a strong rally. This consolidation phase may continue, but investor sentiment remains positive, viewing it as preparation for future price increases.

Hardy’s bullish outlook indicates that DOGE is experiencing healthy consolidation within a broader uptrend, with key support levels identified at $0.40 and $0.36. He predicts that Dogecoin will maintain its current levels for several weeks before resuming upward momentum, aiming for a target of $2 if market conditions remain favorable.

Hardy emphasizes that maintaining key support levels is crucial for sustaining a bullish structure. A new all-time high could be imminent if these conditions persist.

DOGE Price Action: Key Levels to Monitor

Dogecoin (DOGE) trades at $0.40 after a 24% retracement from local highs. Despite this decline, the price remains above this critical demand level, indicating resilience among bulls. The $0.40 zone is pivotal for determining DOGE's next price movements.

Reclaiming the $0.43 level could lead to a retest of the yearly high at $0.484. A breakout above this resistance may reignite bullish momentum and attract renewed interest from traders. Conversely, losing the $0.40 level could indicate growing bearish sentiment, potentially leading to deeper corrections with subsequent support near $0.36, which would challenge the bullish outlook.

Featured image from Dall-E, chart from TradingView