5 0

dYdX Plans US Market Entry by Year-End Amid Policy Shifts

dYdX (DYDX), a leading decentralized crypto trading platform, plans to enter the US market by year-end. This follows supportive crypto policy changes under the Trump administration.

Key Developments

- Eddie Zhang, dYdX's president, highlighted the strategic importance of entering the US market.

- dYdX operates without intermediaries, enabling direct transactions on blockchain networks.

- The platform offers perpetual contracts, allowing speculation on asset prices without ownership or expiration dates, with a total trading volume exceeding $1.5 trillion.

- Plans to introduce spot trading for Solana (SOL), potentially including XRP and Cardano (ADA), to US users by year-end.

- US regulatory support includes the GENIUS Act and potential Market Structure Bill, fostering digital asset ecosystem growth.

Future Prospects

- dYdX plans to significantly reduce trading fees in the US, aiming for 50-65 basis points.

- Perpetual contracts will be unavailable initially, pending regulatory guidance.

- The SEC and CFTC are open to considering crypto perpetual contracts on regulated platforms, which may benefit dYdX.

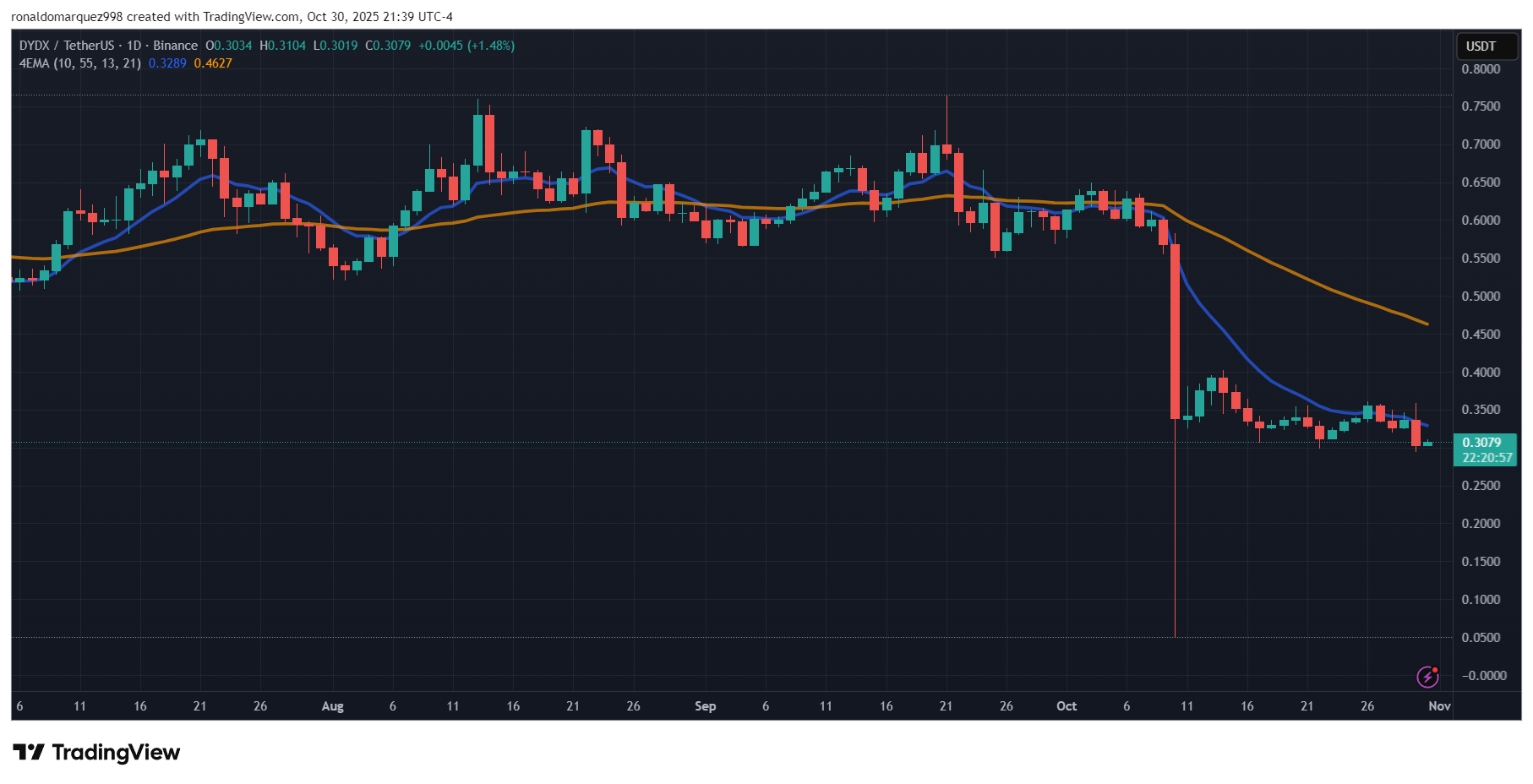

- As of now, DYDX trades around $0.30 but has declined 68% over the past year, losing about $1.43 billion in market cap.