8 1

Ethereum Drops Below $3,000 as Whale Sells 5,000 ETH

Ethereum Price Decline:

- Ethereum fell below the critical $3,000 level, reaching around $2,800, causing market fear and prompting investors to reassess risk.

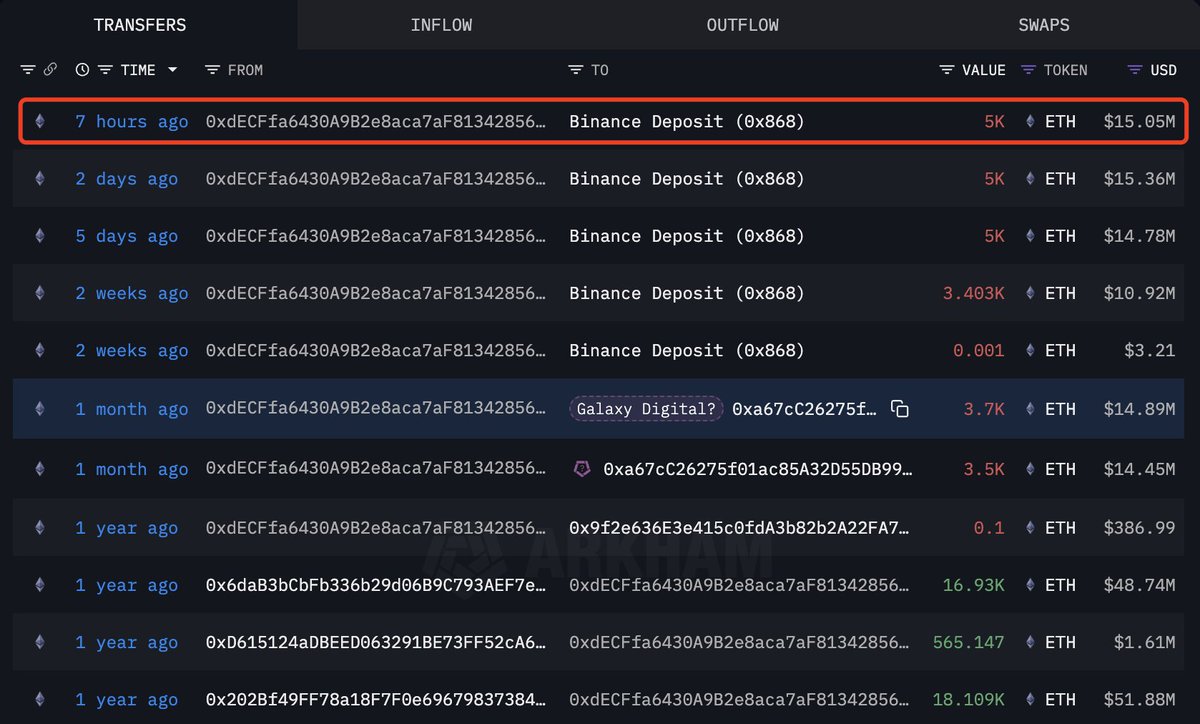

- Significant selling activity by major holders is observed, with a whale depositing 5,000 ETH (approximately $15.05 million) into Binance, signaling potential sell pressure.

- Since October 28, the whale has sold 25,603 ETH (around $85.44 million), indicating possible continued pressure if market conditions worsen.

Market Sentiment and Influences:

- Confidence in the market is fragile due to recent Tether reserve transparency concerns and speculative regulatory scrutiny.

- Rumors of a China Bitcoin ban have resurfaced, further amplifying investor fear.

- These factors contribute to heightened influence from whale distributions, potentially affecting price stability.

Technical Analysis:

- Ethereum struggles to regain momentum after losing the $3,000 mark, trading below key moving averages (50 SMA, 100 SMA, 200 SMA).

- The support zone at $2,750–$2,800 shows buyer defense, but attempts to recover above $3,000 have failed, reinforcing bearish trends.

- A breakdown from a small symmetrical triangle suggests sellers dominate short-term momentum.

- If $2,800 breaks, next support levels are $2,600 and $2,450, where stronger buyer interest may emerge.

- Reclaiming $3,000 with sustained volume is necessary to neutralize bearish pressure.