7 0

Ethereum Exchange Supply Hits 2016 Lows Amid Institutional Accumulation

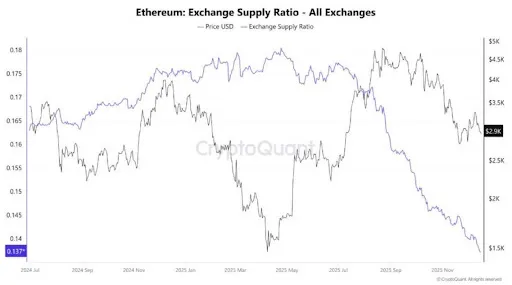

CryptoQuant's latest report reveals a significant decrease in Ethereum's exchange supply, reaching levels not seen since 2016. This shift is linked to increased institutional accumulation and suggests a bullish price outlook.

Key Points:

- The Ethereum exchange supply ratio has dropped to approximately 0.137, among the lowest readings since 2016.

- This metric indicates a reduced fraction of ETH available for liquidation on exchanges, affecting market liquidity.

- A continued outflow of ETH from exchanges to external wallets suggests long-term holding preference over short-term trading.

- The shrinking exchange supply could lead to price increases due to basic supply-and-demand dynamics.

- Historical trends show similar declines in exchange supply during reaccumulation or stable price movements after volatility.

Ethereum on Binance:

- ETH balances on Binance have steadily declined, with the Exchange Supply Ratio at 0.0325.

- This reflects broader market sentiment, as traders hold ETH off exchanges amid market uncertainty.

- The decreasing supply and ETH's price stability suggest lower selling pressure and a potential phase of liquidity absorption.