7 0

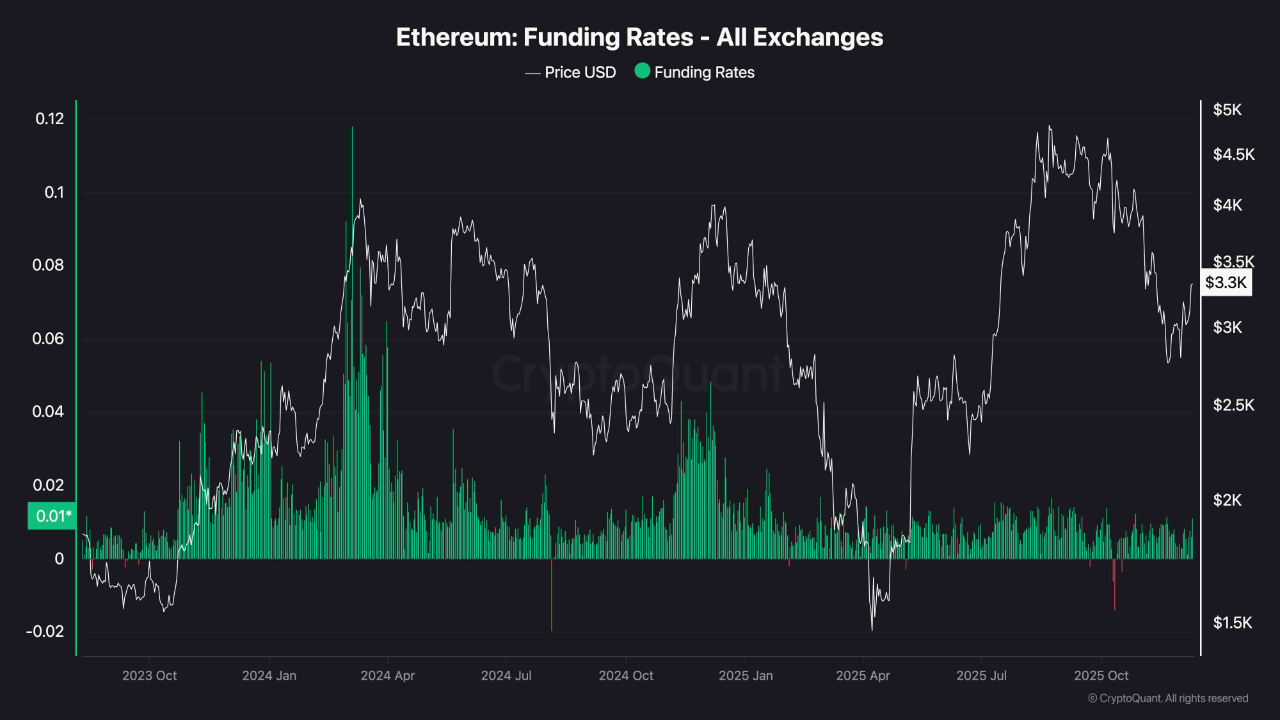

Ethereum Funding Rates Remain Low Despite Recent Price Rally

Ethereum's price has surpassed $3,350, creating market momentum after a period of uncertainty. Despite this increase, sentiment is still cautious with concerns about a potential bear market.

- CryptoQuant reports that Ethereum's funding rates across major exchanges are currently subdued, unlike previous rallies where aggressive funding spikes indicated speculative excess.

- The current rally appears not to be driven by excessive leverage, suggesting different dynamics compared to earlier surges.

- This restrained funding environment suggests spot accumulation is the primary driver, potentially allowing more room for growth if demand increases.

- Lack of speculative demand may hinder a strong bullish continuation unless new buyers emerge to support the rally.

Testing Key Resistance as Momentum Builds

- Ethereum is testing the $3,320 level after rebounding from below $2,800, showing a steady recovery rather than explosive growth.

- The 200-day moving average is a critical resistance point; reclaiming it could signal a shift from correction to a bullish cycle.

- Despite higher lows indicating buyer accumulation, volume remains subdued, signaling a need for stronger buying pressure to decisively turn the trend bullish.

- Breaking above the $3,350–$3,400 resistance zone is crucial for sustained momentum.