4 0

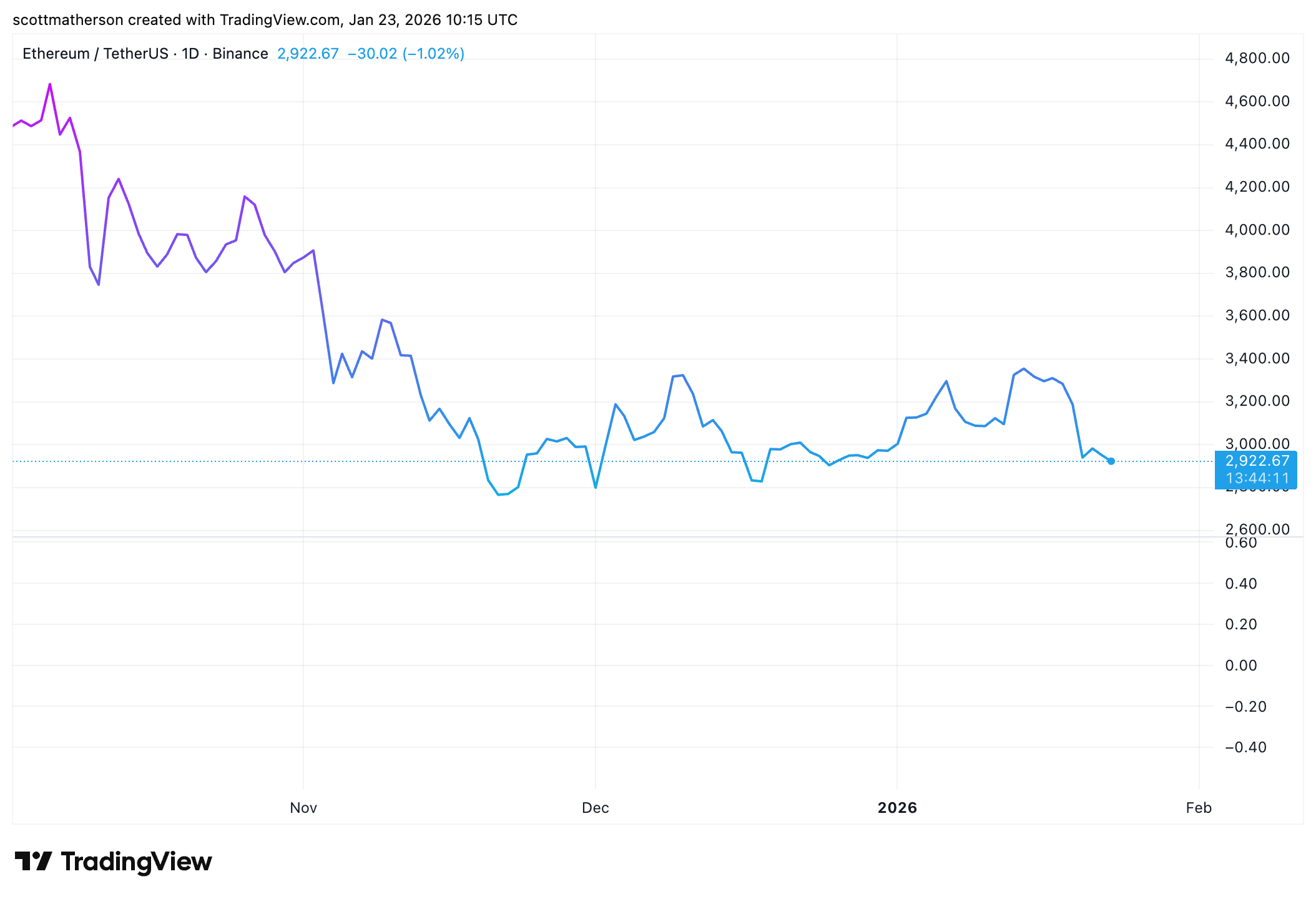

Ethereum Funding Rates Edge Negative as Price Struggles Below $3,000

Ethereum Under Pressure Below $3,000

- Ethereum is trading at $2,925, down 2.7% within a 24-hour range of $3,012.99 to $2,909.60.

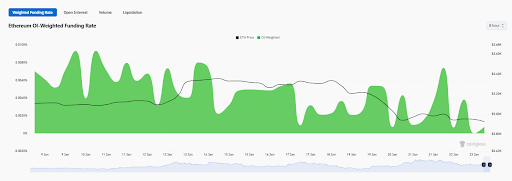

- On-chain data shows funding rates moving towards negative, indicating defensive derivative positioning.

Funding Rates and Market Sentiment

- The OI-weighted funding rate for Ethereum is compressing, close to negative levels at 0.0008%, compared to 0.009% earlier in the month.

- Negative funding rates suggest stronger demand for short positions, indicating bearish sentiment.

Open Interest and Liquidations

- Total open interest remains high, increasing by 0.68% to about 13.36 million ETH (~$39.19 billion).

- Binance holds the largest share of ETH open interest at $8.95 billion, down by 0.8% in 24 hours. CME follows with $5.73 billion, up by 3.72%.

- Ethereum liquidations reached $64.34 million in the last 24 hours, with long positions accounting for $52.52 million.

A hold above $2,900 could stabilize funding rates, potentially leading to a rebound attempt towards $3,000. Continued negative funding rates may lead to further bearish pressure below $2,900.