1 0

BEARISH 📉 : ETH Holders Face Unrealized Losses as Selling Pressure Increases

Ether remains stable around $2,200 as it experiences ETF inflows and significant holder activity.

- Ethereum spot ETFs recorded net inflows of $14.06 million on Feb. 3, contrasting with Bitcoin's $272 million net outflows.

- Large holders are buying Ether dips; three dormant wallets spent $13.1 million to acquire 5,970 ETH at $2,195 each.

- Despite these activities, ETH struggles to break the $2,400 resistance level.

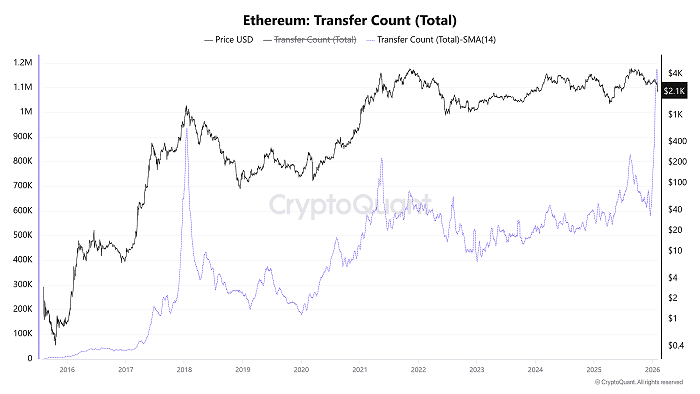

Ethereum Transfer Spike Raises Concerns

- Ethereum's transfer count reached 1.17 million on Jan. 29, a level only seen twice before, preceding major price drops.

- This spike suggests high trading activity near price extremes, indicating potential risk.

Holders See High Unrealized Losses

- Ether's decline has increased unrealized losses among large holders; BitMine faces nearly $7 billion in paper losses.

- Trend Research and Garrett Jin sold 316,185 ETH worth about $738 million on Binance to repay loans and avoid liquidation.

- A trader recently profited $7.2 million from shorts and opened new 20x short positions on 21,838 ETH valued near $49.3 million.