10 0

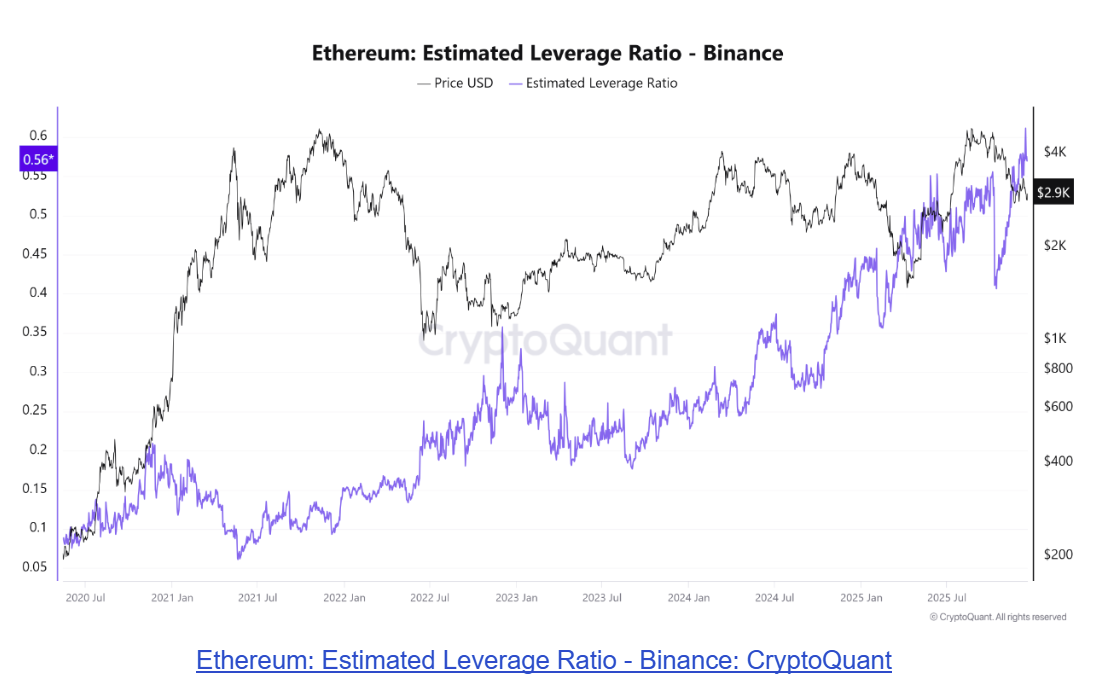

Ethereum Leverage Ratio Hits Record High as Price Nears $3,000

The Ethereum derivatives market is experiencing a shift, with price action expected to rise above $3,000. On-chain data indicates trader behavior is moving into an accumulative phase.

- Ethereum's Estimated Leverage Ratio on Binance has reached an all-time high of 0.611, showing increased risk appetite among investors.

- A Taker Buy Sell Ratio of 1.13 on Binance highlights strong demand, suggesting more buy orders than sell orders.

- This combination of rising leverage and taker demand suggests optimism in the short term, with Ethereum currently trading around $2,900.

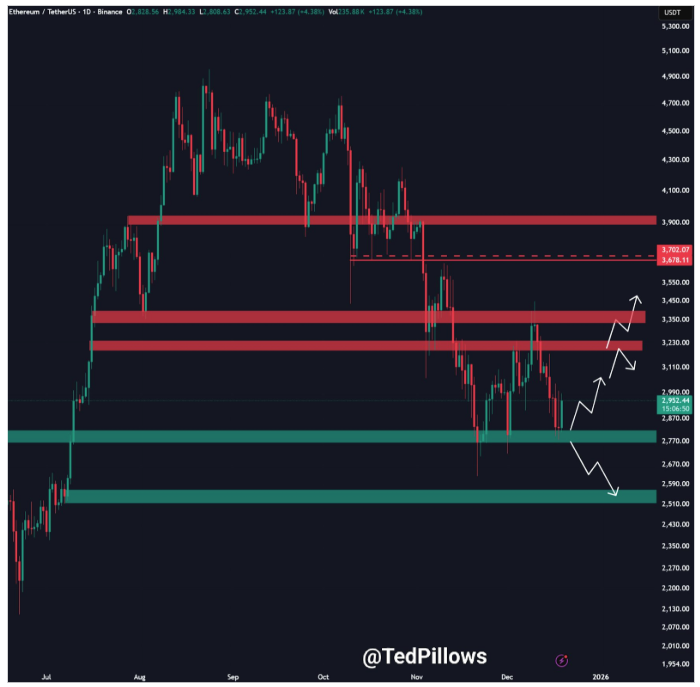

Analyst Ted Pillows provides a technical analysis:

- Ethereum is rebounding from a demand zone between $2,700 and $2,800, which acts as a major support band.

- If this support holds, Ethereum might push toward the $3,100 to $3,200 range.

- If the support fails, a deeper pullback could test the $2,500 level.