8 0

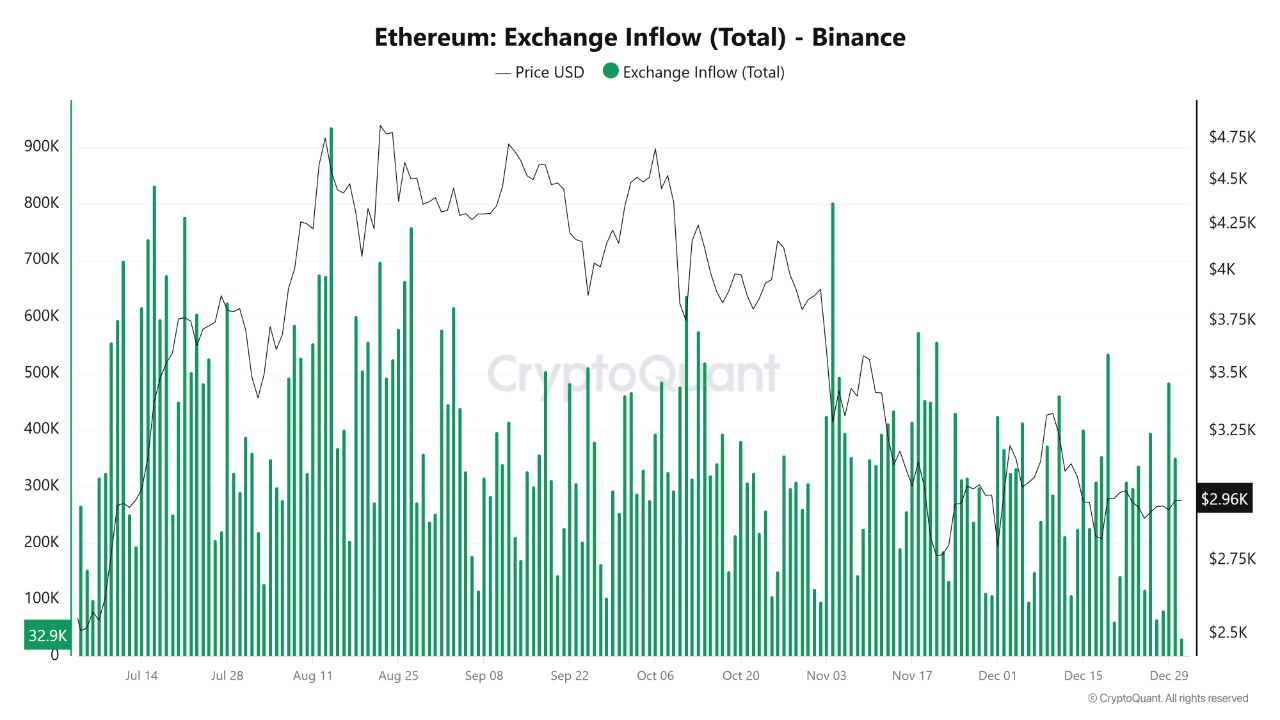

Ethereum Liquidity Surges on Binance with 8.5 Million ETH Inflows in December

Ethereum Market Overview:

- Ethereum is struggling to break the $3,000 resistance level, showing weak price action and vulnerability to downside pressure.

- Market sentiment remains bearish, with fading momentum indicators and subdued risk appetite among investors.

On-Chain Data and Liquidity Insights:

- According to CryptoQuant, Ethereum reserves on Binance surged to 4.17 million ETH in December.

- The month saw inflows of nearly 8.5 million ETH, a major event since 2023, indicating increased trading activity or potential selling pressure rather than long-term accumulation.

- Higher exchange balances typically increase ETH's tradable supply, affecting short- to medium-term supply-demand dynamics.

- Increased exchange liquidity often precedes volatility, especially when prices struggle to regain key levels.

Market Technical Analysis:

- Ethereum's price range is compressed between $2,900 and $3,100, indicating indecision and lack of conviction among traders.

- Technical indicators show ETH capped below its 50, 100, and 200-period moving averages, sustaining a broader bearish trend.

- Trading activity has decreased, reflecting reduced participation and market apathy.

- A breakout above $3,100 is necessary for a bullish shift; otherwise, ETH risks continued downside if market sentiment worsens.

Ethereum's current state suggests potential for increased volatility, with significant market movements likely depending on broader market trends and investor behavior.