6 0

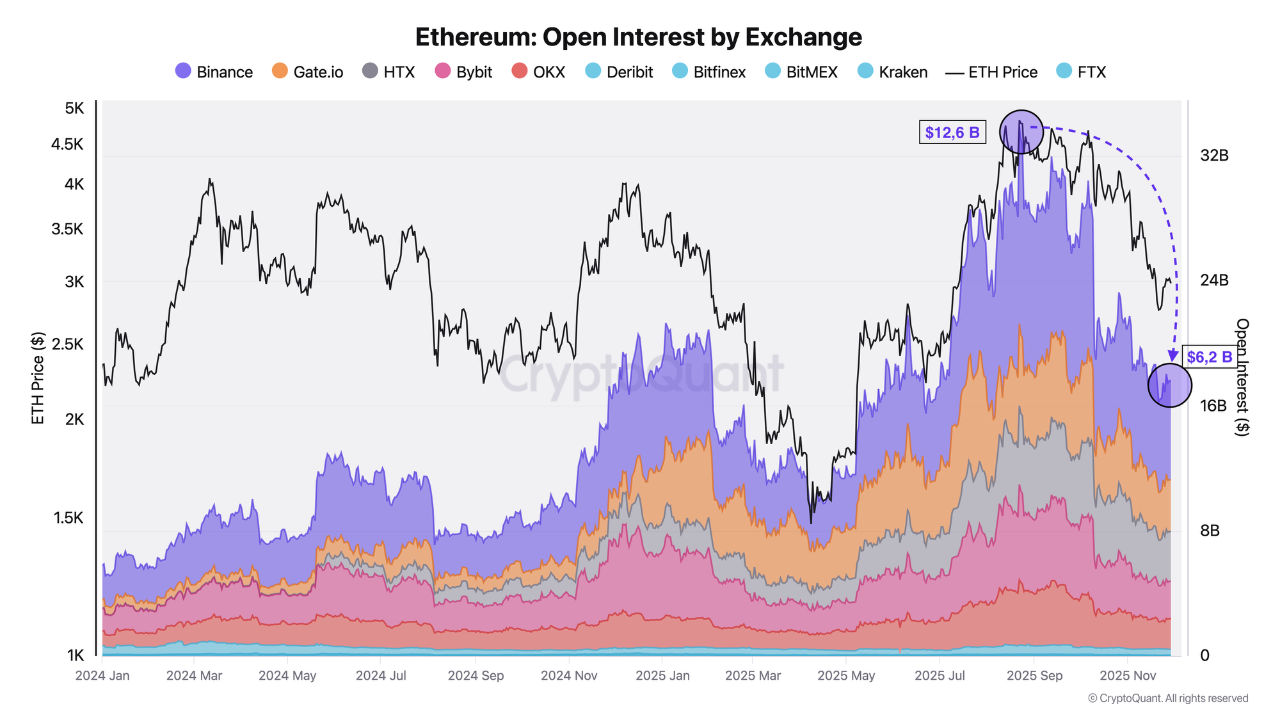

Ethereum Open Interest Drops 51% as Market Undergoes Deep Reset

Ethereum Market Update:

- Ethereum has fallen below the $2,800 mark, signaling potential market panic and loss of bullish control.

- Selling pressure and rising volatility have intensified, with traders struggling to find a reliable support zone.

- Ethereum's open interest on Binance has decreased by 51%, from $12.6 billion to $6.2 billion in three months.

- This decline suggests a deeper structural reset within the derivatives market.

Speculative Position Unwind Across Exchanges

- The contraction in open interest is not limited to Binance; it is evident across major platforms.

- Gate.io saw Ethereum's open interest drop from $5.2 billion to $3.5 billion.

- Bybit experienced a decrease from $6.1 billion to $2.3 billion.

This widespread reduction in leverage implies a substantial market reset. Investors are hesitant to re-enter positions due to ongoing liquidations.

Technical Indicators Turn Bearish

- Ethereum's 3-day chart shows a breakdown in structure, with price below the 50 SMA, 100 SMA, and 200 SMA.

- The rejection from the $3,600–$3,800 region confirmed a shift toward a downtrend.

- The 50 SMA has crossed below the 100 SMA, indicating potential sustained corrections.

- Volume increase on red candles shows seller dominance; buyers show little conviction at current levels.

- Potential support levels are near $2,550 and $2,300 if the $2,750 support breaks.