15 1

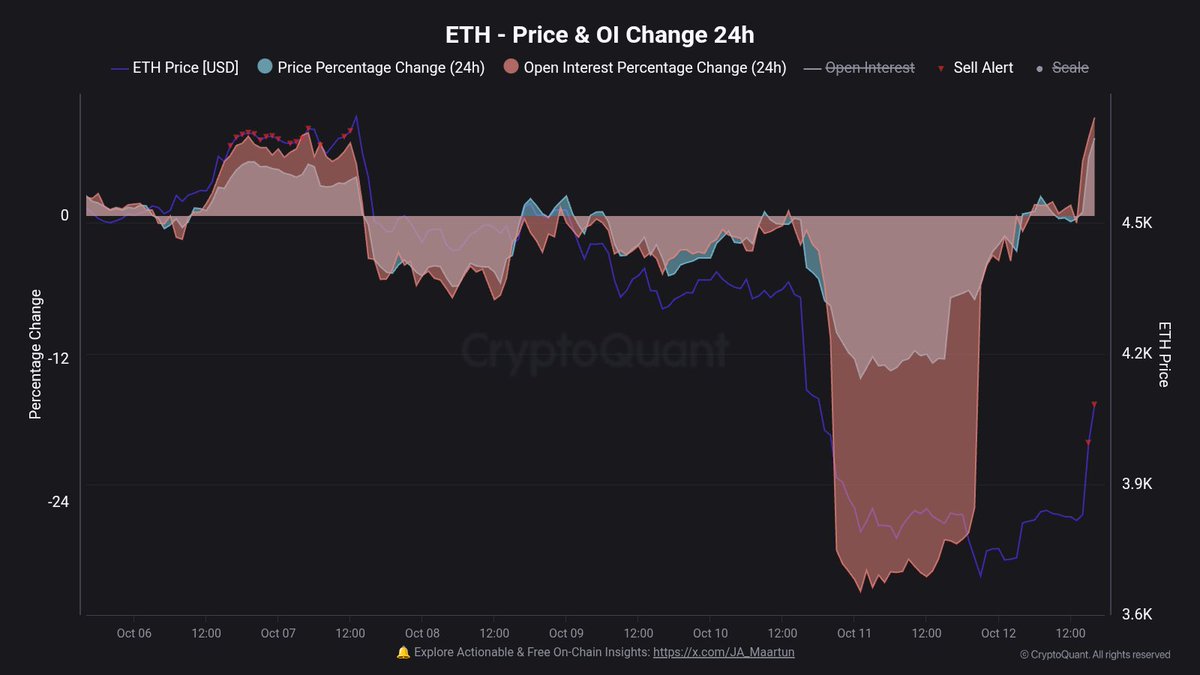

Ethereum Open Interest Surges 8.2% Amid Renewed Leverage Activity

Ethereum is stabilizing after a significant sell-off, with prices dropping to $3,450 amidst the largest liquidation event in crypto market history. This event wiped out billions in leveraged positions across major exchanges.

- ETH is showing signs of recovery as buying interest emerges near key demand zones.

- Onchain analyst Maartunn notes leverage is building up again, with open interest on ETH increasing by 8.2% in 24 hours, signaling speculative activity resumption.

- The rise in leverage could lead to either a short-term relief rally or further liquidations if momentum fades.

Market Dynamics and Risks

- Leverages return, raising the risk of another wave of forced liquidations if traders overextend positions.

- Historically, similar leverage-driven recoveries revert around 75% of the time, leading to pullbacks once liquidity normalizes.

- Ethereum's short-term recovery remains driven by derivatives rather than spot demand.

Technical Analysis and Resistance Levels

- ETH rebounded from the 200-day moving average, currently consolidating near $4,150.

- Immediate resistance lies between $4,250–$4,300, aligning with the 50-day moving average.

- If sustained above $4,000, targets include $4,500 and $4,750; failure could result in a retest of $3,600 or lower.

Ethereum's recovery is technically constructive but must overcome resistance to confirm a sustainable rebound beyond short-term oversold reactions.