14 0

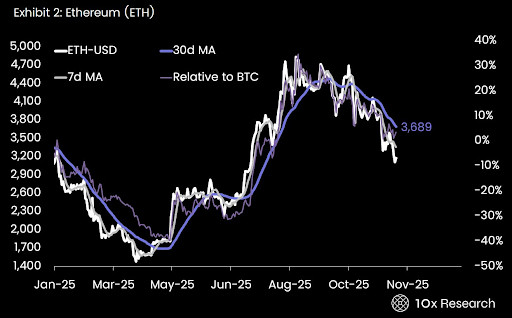

Ethereum Price Drops Below Moving Averages Amid $1.4B ETF Outflows

The price of Ethereum has entered a bearish phase, driven by weakening momentum, significant ETF outflows, and selling from long-term holders. Concerns are rising about a potential deeper correction as the $3,000 price level comes back into focus.

Key Points

- Ethereum is trading below both its 7-day and 30-day moving averages, indicating bearish momentum.

- Over the past week, Ethereum's price dropped by 6.6% without regaining the short-term trendline.

- Since early November, spot ETH ETFs have experienced over $1.4 billion in net outflows, showing reduced institutional interest.

- Long-term holders are selling at their fastest rate since 2021, contributing to increased supply on exchanges.

- Despite this, some large whale investors are accumulating Ethereum, though not enough to offset selling pressures.

- Ethereum is currently trading around $3,182, with recent intraday lows reaching $3,023, close to the critical support level at $3,000.

If selling pressure persists, Ethereum could slide further below the $3,150 to $3,200 range, making a drop to $3,000 increasingly likely.