6 0

Ethereum Price Falls Below $3,000; Profitability Drops Under 60%

Ethereum has experienced a decline, with its price falling below $3,000, impacting investor positioning. Key points:

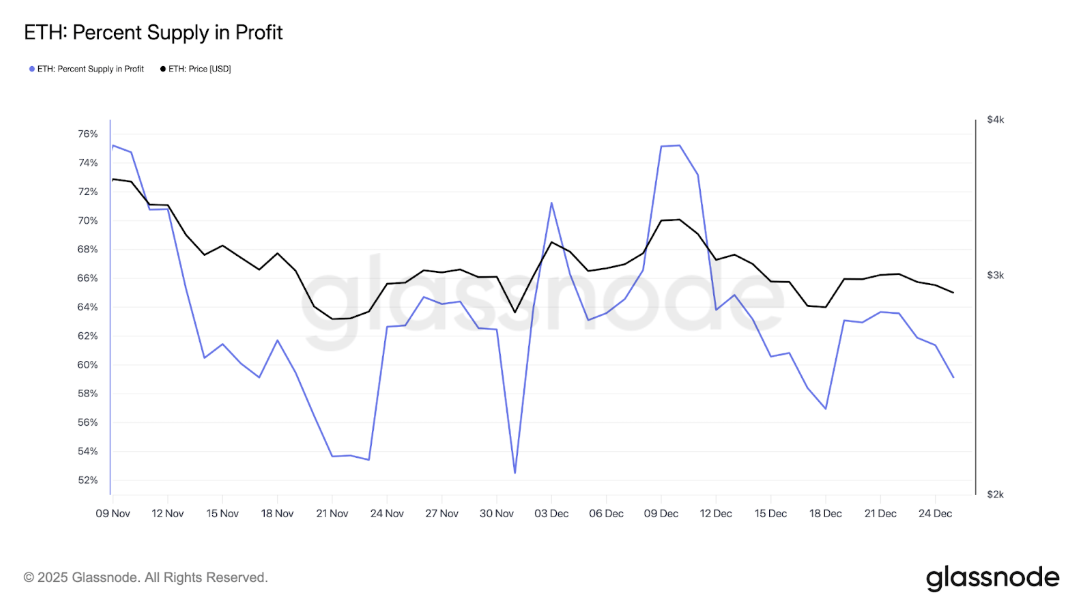

- On-chain data indicates a drop in Ethereum's supply profitability below 60%, reflecting recent price actions.

- Institutional demand for Ethereum has decreased, evidenced by reduced retail profitability and institutional participation.

Supply Profitability Concerns

- Ethereum briefly reclaimed the $3,000 level on December 22 but fell back shortly after.

- The percentage of ETH supply in profit previously rose to 63% but has fallen under 60%, affecting both recent and earlier investors.

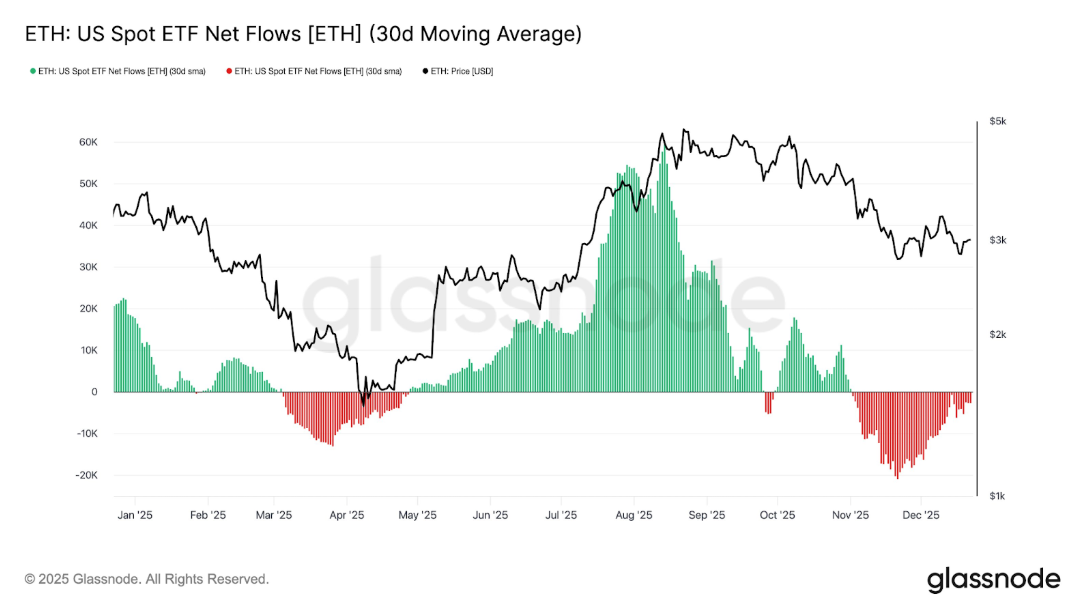

ETF Net Outflows

- The 30-day moving average of US Spot Ethereum ETFs has shown negative net flows since early November.

- Continued outflows replaced previous inflows that had driven Ethereum to new highs in August.

- This trend contributes to Ethereum's struggle to maintain its price above $3,000 due to weakened ETF demand.

Additional factors include on-chain data showing whales reducing Ethereum exposure. Notable moves:

- A wallet linked to Erik Voorhees, incorrectly identified, reportedly exchanged 4,619 ETH for Bitcoin Cash.

- Arthur Hayes, BitMEX co-founder, sold 1,871 ETH worth about $5.53 million recently.