5 1

Ethereum Rally Stalls As Spot And Perpetual Volumes Flatten On Binance

Ethereum (ETH) has seen a price increase of approximately 80% over the past three months but experienced a 0.6% decline in the last month.

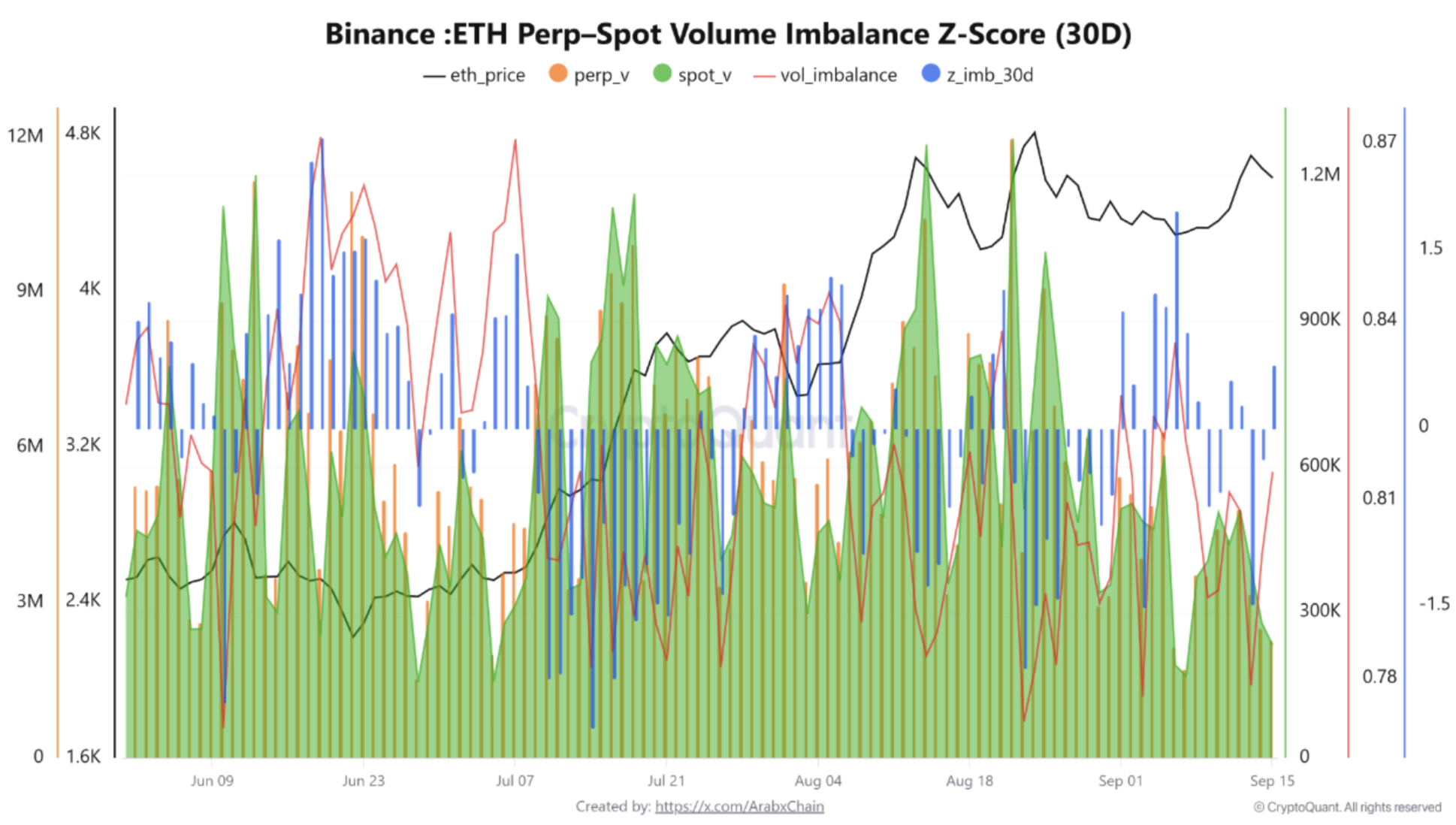

Binance Ethereum Trading Trends

- September 2025 shows a period of calm in ETH trading on Binance, with a decrease in the imbalance between spot and perpetual volumes.

- The recent ETH rally from $2,127 to $4,500 lacked strong momentum from both spot and leveraged markets.

- ETH's Z-score has mostly ranged between 0.0 and -1.0, indicating neutral trading with a slight preference for the spot market.

The Z-score suggests a decline in perpetual contract dominance, potentially due to reduced speculative activity or increased reliance on real buy/sell orders.

- Spot volume has remained low, below the 500K–1M range.

- This reflects limited investor engagement compared to peaks in June and July.

- There is a lack of strong imbalances, which could signal market uncertainty and stagnation.

Future Outlook for ETH

- Some analysts predict a bullish turn for ETH due to decreasing reserves on exchanges and strong institutional demand.

- Forecasts suggest a potential rise to $6,800 by the end of 2025.

- Currently, ETH trades at $4,439, down 1.6% in the last 24 hours.