1 0

Ethereum Reserves Fall to 16.2 Million ETH, Lowest Since 2016

Ethereum has once again fallen below the $3,000 mark due to increased selling pressure across the crypto market. This movement indicates trader caution, with volatility rising and liquidity decreasing around key support areas.

- Despite short-term price weakness, on-chain data reveals a significant drop in Ethereum reserves on centralized exchanges, now at their lowest since 2016.

- This reduction suggests a long-term trend of withdrawals, potentially indicating a shift towards long-term holding or deployment in DeFi.

- Fewer coins on exchanges typically mean less immediate supply for spot selling during market stress.

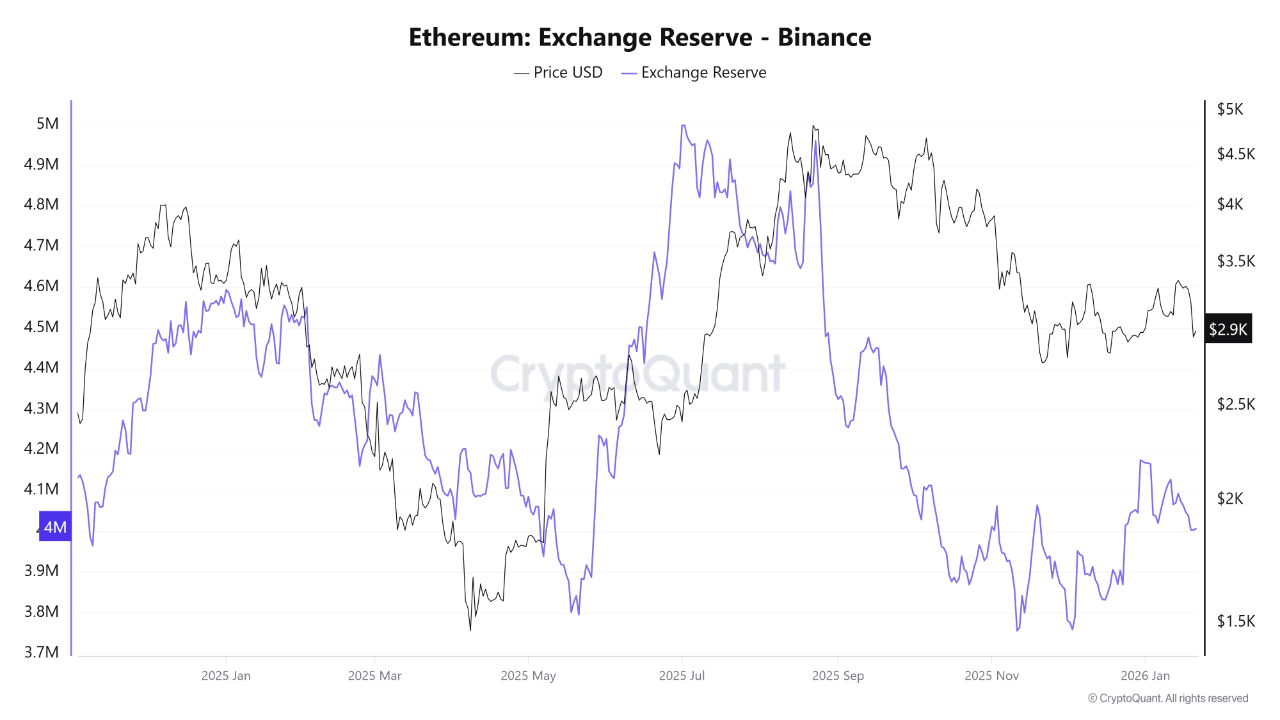

Binance Reserves Decline

- CryptoQuant analysis shows Binance’s Ethereum reserves have decreased from approximately 4.168 million ETH to 4.0 million ETH since early 2026.

- This steady withdrawal occurs without significant inflows, implying that sellers are not increasing liquid supply aggressively.

- The ongoing reserve decline could influence the supply-demand balance if demand rebounds, as there will be less available ETH to meet buying interest.

Ethereum's Price Struggles

- Ethereum failed to hold above $3,000, currently near $2,970.

- The recent attempt to reach the $3,300–$3,400 zone was unsuccessful, with sellers pushing prices lower.

- The rejection near the 200-day moving average underscores ongoing bearish sentiment.

- Focus is now on the $2,850–$2,900 support area; failure here could lead to further declines.

To regain control, Ethereum must reclaim the $3,000 level and establish stronger demand above it.