Ethereum’s Based Rollups Gain Popularity for Enhanced Sequencing and Interoperability

Ethereum is increasingly utilizing rollups, particularly "based" rollups.

What are Based Rollups?

Based rollups feature a sequencer that differs from traditional layer-2 solutions. Instead of relying on a centralized sequencer for transaction ordering, based rollups delegate this to Ethereum layer-1 validators, a process known as "based sequencing."

Advantages of Based Rollups

Two main benefits include:

- Censorship Resistance: Utilizing layer-1 ensures transaction liveness guarantees similar to those of Ethereum blocks and mitigates censorship risks associated with centralized sequencers.

- Interoperability: Proponents highlight "synchronous composability," allowing smart contracts across different layer-2s to interact seamlessly within the same block.

This restores Ethereum's original vision of composability, but current fragmented rollup states create fee uncertainty due to asynchronous transactions across different platforms.

Cost Efficiency

Synchronous composability can lead to cost savings. Users could execute transactions between layer-1 and layer-2 more efficiently, leveraging deep liquidity pools without multiple transaction fees.

Current Implementations

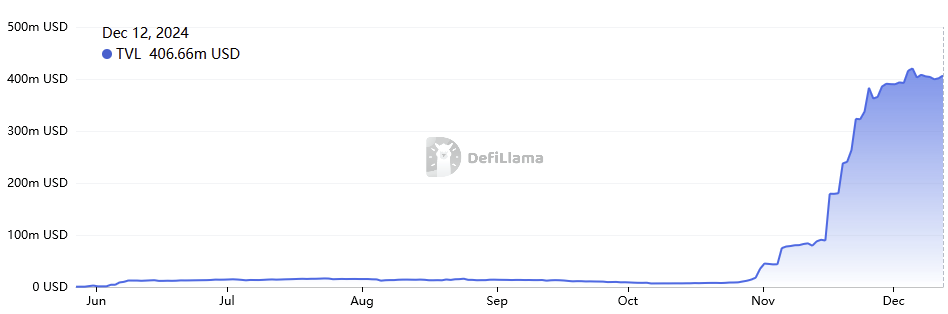

The largest operational based rollup is Taiko, which has recently experienced growth in total value locked (TVL) and daily transactions. Other early-stage based rollups include Surge by Nethermind and UniFi by Puffer Finance, both forking from Taiko.

Challenges of Based Rollups

Based rollups face limitations due to reliance on layer-1’s 12-second block time, which may hinder synchronous composability. Real-time proof generation within this timeframe is essential for fast execution of composable transactions.

Taiko has implemented two zk proofs by Risc Zero and Succinct Labs to enhance its capabilities, becoming the first multi-proof based rollup in production without dependence on a single trusted party.

Monetization Concerns

The absence of a centralized sequencer may reduce miner extractable value (MEV) revenue streams. However, there are strategies to capture MEV through auctioning execution tickets to layer-1 block proposers. Alternative distribution methods for sequencing rights also exist, potentially balancing MEV concerns.

Future revenue models for rollups may focus on congestion fees, which currently dominate blockchain revenue compared to diminished MEV revenues.

Conclusion

Based rollups aim to restore the user experience of Ethereum by reintroducing synchronous composability and layer-1 transaction sequencing. This return aligns with blockchain principles established since Bitcoin's inception, challenging the recent shift towards decentralized execution layers.