6 0

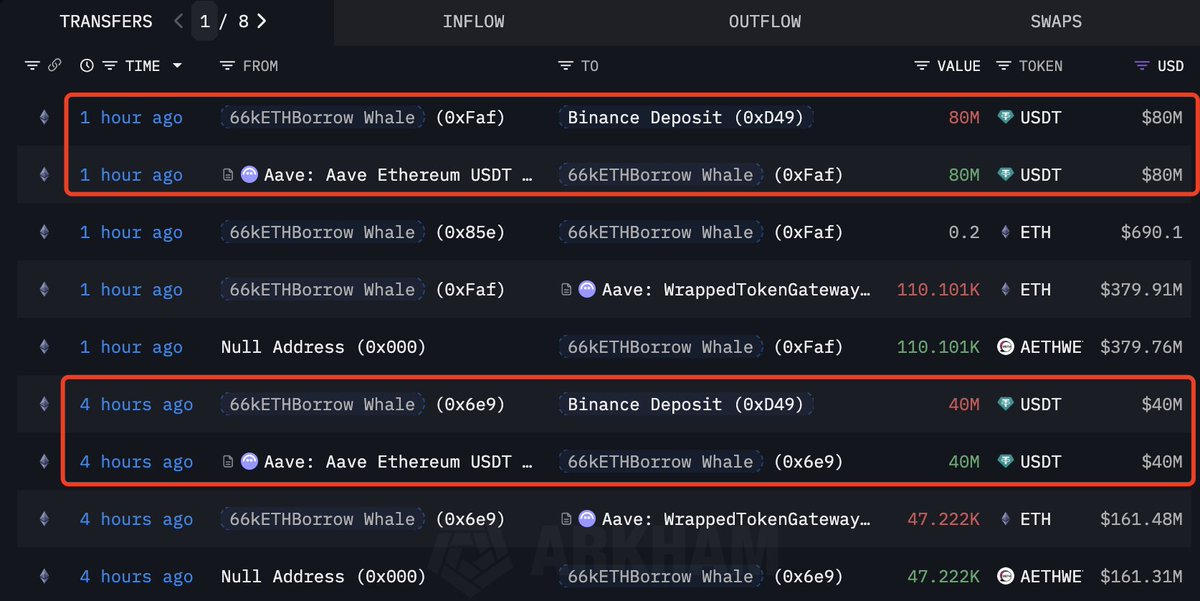

Ethereum Whale Moves $120M USDT to Binance for Potential Accumulation

Ethereum Price Struggles Amid Market Uncertainty

- Ethereum is facing challenges in breaking above the $3,600 resistance level, remaining range-bound due to selling pressure and market uncertainty.

- Analysts suggest this phase might be a final shakeout before a potential rally.

Whale Accumulation Signals Confidence

- On-chain data shows large holders, including institutions and crypto whales, are accumulating ETH despite volatility.

- The Ethereum whale “66kETHBorrow” has purchased 385,718 ETH (~$1.33 billion) since November and borrowed an additional $120 million USDT for further accumulation.

- This behavior suggests confidence in Ethereum's medium-term prospects, potentially indicating a price rebound.

Market Dynamics and Risks

- Leveraged accumulation by whales can create upward market pressure but also carries risks if support levels aren't maintained.

- If Ethereum falls below $3,400–$3,500, it may face increased liquidation pressure.

Technical Analysis: Consolidation Patterns

- Ethereum is consolidating above $3,450–$3,500, with bulls and bears in a standoff.

- The 200-day moving average offers crucial support, while failure to surpass the 50-day moving average indicates weakening downside momentum.

- A close above $3,650 could lead to a move toward $3,900–$4,000, whereas dropping below $3,400 might target the $3,100 zone.