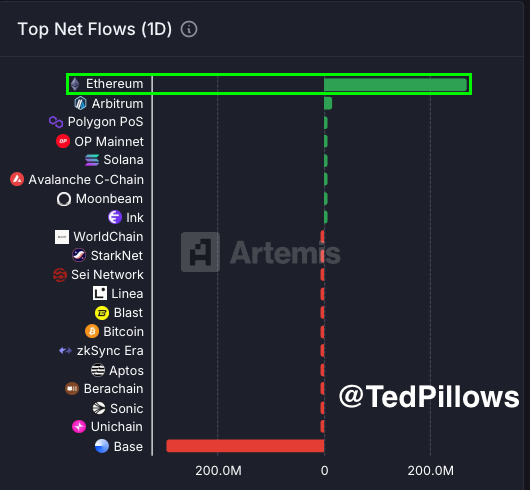

Ethereum Records $269 Million in Net Inflows Amid Market Optimism

Ethereum is at a critical juncture, trading around $2,500, with bulls and bears in a standoff.

- Bulls have not established control above $2,500.

- Bears have not pushed prices to new lows.

- Recent US stock market highs suggest potential for crypto gains.

Ethereum saw over $269 million in net inflows within 24 hours, indicating renewed investor confidence. This influx could catalyze further price action as global liquidity increases.

The $2,500 resistance level remains crucial; a breakout could lead to significant upward movement and potentially trigger an altcoin recovery.

Current Trading Range and Market Conditions

Ethereum has been consolidating between $2,200 and $2,800 for weeks. A definitive breakout is awaited to initiate an "altseason."

- Recent macroeconomic factors cause cautious market reactions.

- Ethereum's resilience suggests it may act as a catalyst for a broader altcoin rally.

- Investor behavior data indicates rising demand from both institutional and retail investors.

Ethereum trades at $2,427, below its 200-day simple moving average (SMA) of $2,544. It has bounced off support near $2,200 and held above the 100-day SMA of $2,167, but remains capped by resistance levels:

- 50-day SMA at $2,534

- 200-day SMA near $2,540

A strong close above $2,540–$2,550 could confirm a bullish breakout toward $2,800. Conversely, a drop below $2,300 would weaken the current setup.