Ethereum Reaches $3,424 Amid Positive Funding Rates and Market Optimism

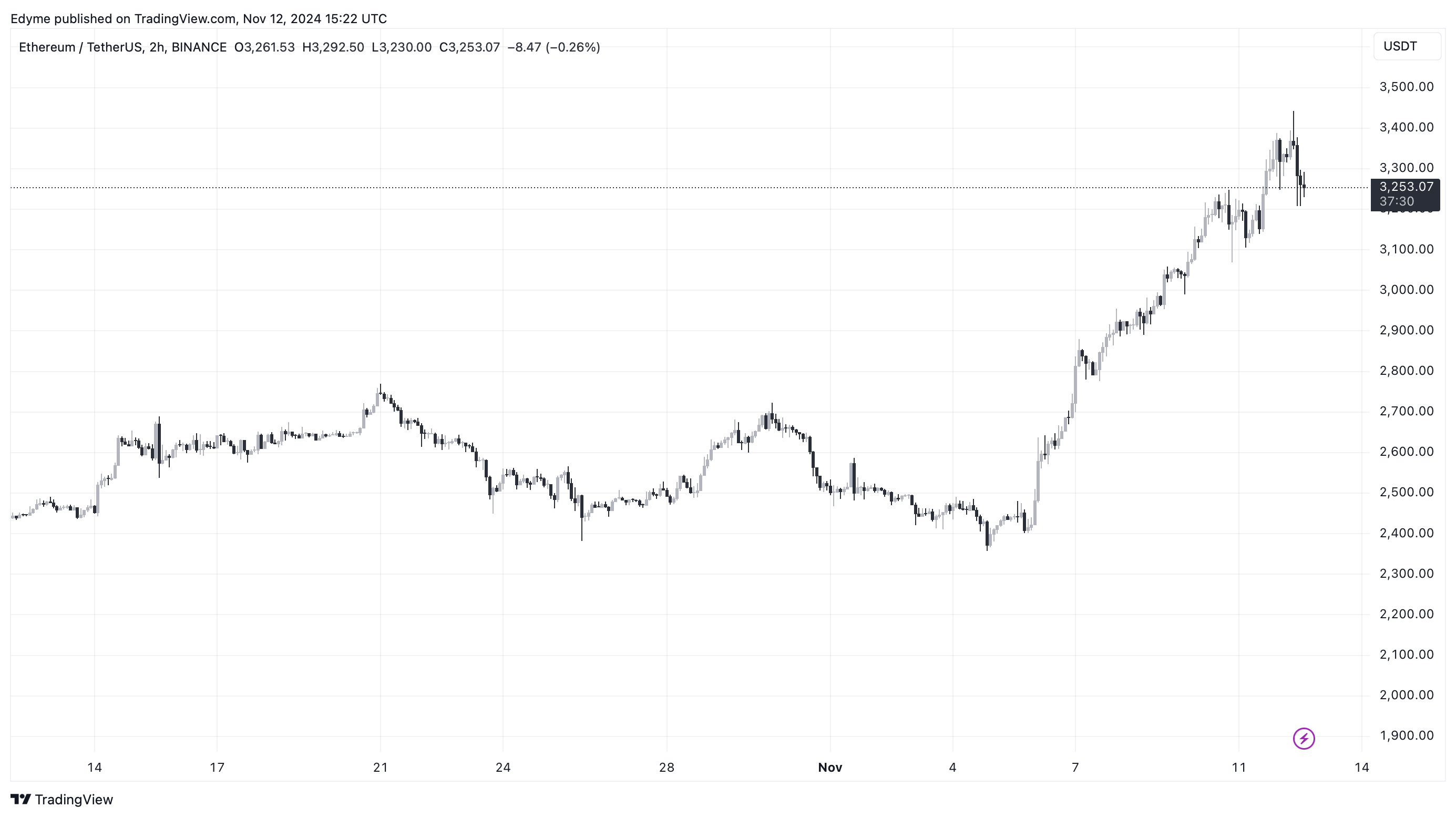

Ethereum has recently reached a significant high above $3,400, indicating potential upward momentum that could lead to prices exceeding $4,000 and possibly achieving a new all-time high.

This resurgence in price has generated speculation within the crypto community regarding ETH's future trajectory.

Ethereum Rise and Market Sentiment

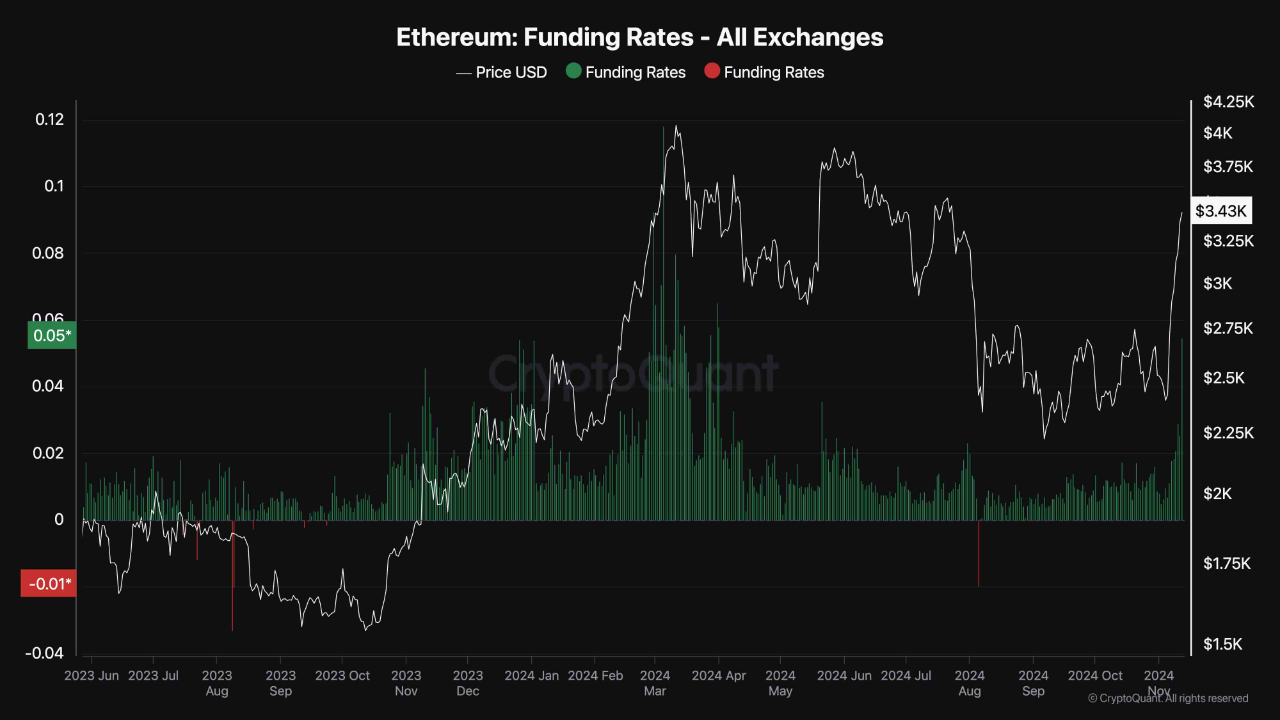

A report from CryptoQuant analyst ShayanBTC states that Ethereum's price has increased by 35% in the past week, with positive sentiment reflected in the futures market. Key indicators show strong demand and bullish sentiment among investors, as evidenced by positive funding rates for Ethereum futures.

Positive funding rates indicate buyers are paying a premium to hold long positions, demonstrating market confidence. This trend was notably observed when Ethereum surpassed $3,000, mirroring patterns from the previous March rally.

This situation raises concerns about whether current momentum can be maintained or if the market might face sudden reversals, similar to earlier this year.

What Is Expected

While positive funding rates signal market interest, they may also indicate risk when excessively high. Shayan noted that elevated funding rates can signify an "overheated" market, increasing the chance of a liquidation cascade if prices encounter significant resistance or minor corrections.

High funding rates suggest traders may be over-leveraged, creating conditions for sell-offs during sharp price pullbacks. The analyst advised caution, recommending strategies to mitigate potential risks associated with heightened funding rates and potential market volatility.

Ethereum briefly traded as high as $3,424 but has since experienced a slight correction, currently trading at $3,289, reflecting a 2.2% increase over the past day.

Featured image created with DALL-E, Chart from TradingView