Sell Pressure Increases as Ethereum Tests $4,000 Resistance Level

Ethereum surpassed the $4,000 price mark on December 6, currently trading at $4,003 with a 2.7% increase in the past day. Despite this milestone, market metrics indicate potential risks of profit-taking and corrections.

Another Major Correction Incoming?

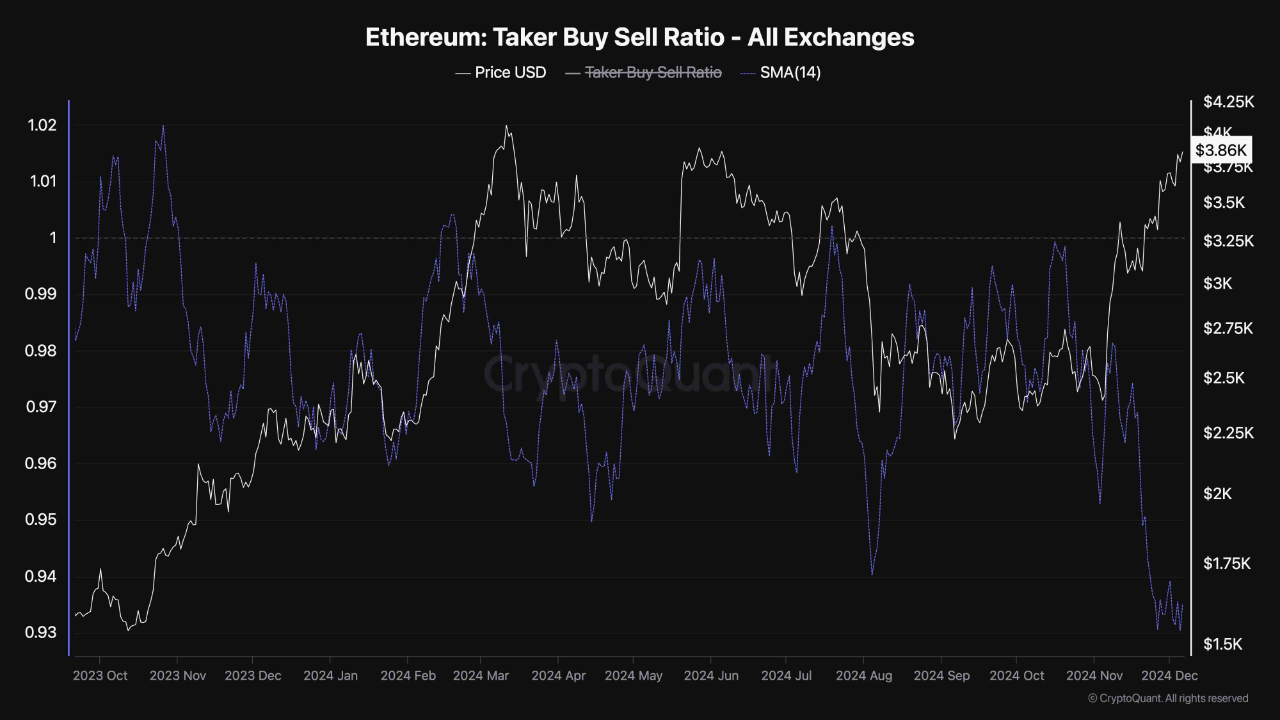

A CryptoQuant analyst, ShayanBTC, has provided insights into Ethereum’s futures market behavior, suggesting caution may be warranted. The Taker Buy/Sell Ratio, a key market sentiment indicator, shows a significant rise in sell-side activity as Ethereum approaches the $4,000 resistance level.

This metric indicates that sellers are increasingly dominating trades as the price rises. Shayan noted that futures market participants appear to be locking in profits or bracing for a potential price correction.

The Taker Buy/Sell Ratio has reached its lowest point in several months, signaling a risk-off approach among market participants.

This trend suggests aggressive futures market sell orders could slow Ethereum’s upward momentum, leading to a potential pullback or consolidation phase.

The drop in the Taker Buy Sell Ratio implies a possible slowdown in upward price movement as more market participants take a risk-off approach. This aligns with anticipating a price pullback or a correction phase, making it crucial for traders to monitor the futures market for further developments.

What Next For Ethereum?

Ethereum remains above $4,000, up by 3.1% in the past day, boosting its market cap above $482 billion and daily trading volume to approximately $56.7 billion.

The decline in the Taker Buy/Sell Ratio indicates cautious sentiment among futures market participants, often preceding increased market volatility. While this does not necessarily signify the end of Ethereum’s rally, it underscores the need to closely monitor market developments. Should selling pressure escalate, Ethereum could face a price correction, presenting opportunities for new entrants or long-term holders to accumulate at lower levels.

From a technical perspective, ETH may be poised for a major rally, having recently formed a golden cross (50DMA and 200DMA) on its price chart.

$ETH goldencross (50DMA and 200DMA) has occurred!

Last time this happened, #Ethereum was still in consolidation stages of the bear market but it still went +129%

In the 2021 bull market, the last golden cross took #ETH +2,323% pic.twitter.com/Wd7GGMc7O4

— venturefounder (@venturefounder) December 6, 2024

Featured image created with DALL-E, Chart from TradingView.