Ethereum Sees Over $754 Million Withdrawn by Investors from Exchanges

On-chain data indicates a significant outflow of Ethereum from exchanges, potentially signaling bullish sentiment for ETH's value.

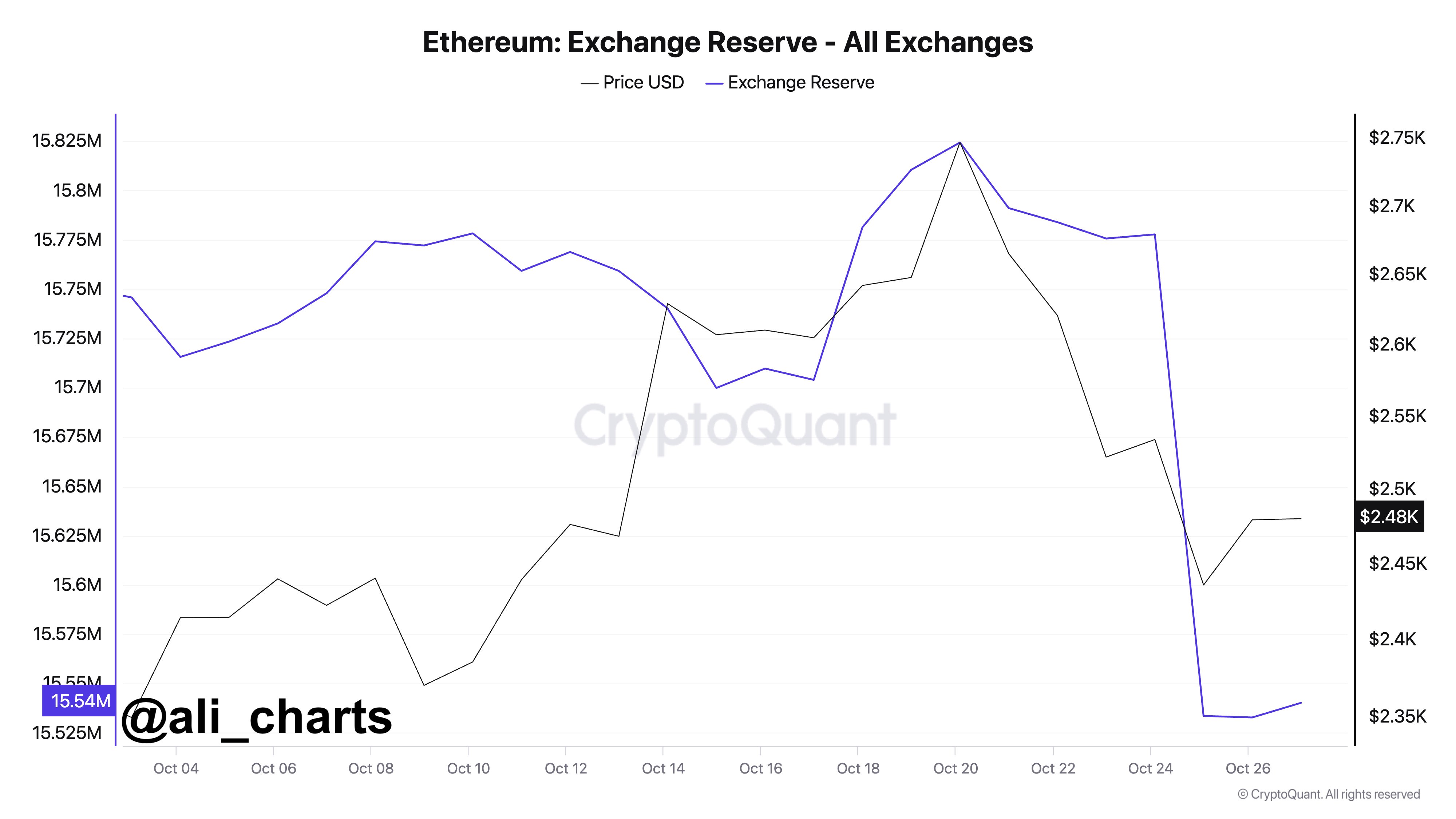

Ethereum Exchange Reserve Decline

Analyst Ali Martinez noted in a post on X that ETH investors have recently withdrawn net amounts from exchanges. The relevant on-chain metric is the Exchange Reserve, which tracks the total Ethereum held in centralized exchange wallets.

An increase in this metric suggests net inflows, often indicating selling intentions, which can negatively impact asset prices. Conversely, a decline suggests net withdrawals, indicating accumulation, which may be bullish for the cryptocurrency.

The chart below illustrates the trend in Ethereum Exchange Reserve over recent weeks:

The graph shows a substantial drop in the Ethereum Exchange Reserve, indicating large net withdrawals by investors.

Over the past week, holders have withdrawn more than 300,000 ETH, valued at approximately $754 million. This activity likely stems from whale entities taking advantage of lower prices following ETH's decrease from its $2,700 high earlier this month.

If true, Ethereum could rebound from this decline in the Exchange Reserve, as ETH has now surpassed the $2,500 threshold.

Additionally, market intelligence platform IntoTheBlock reported via an X post that the Ethereum Market Value to Realized Value (MVRV) Ratio currently stands at 1.2.

The MVRV Ratio compares the current value of Ethereum holdings to the initial investment. A ratio of 1.2 indicates that average ETH holders are currently in profit. Historically, ETH has encountered peaks at higher MVRV values, suggesting the current profitability may not be sufficient for a price top.

ETH Price

Currently, Ethereum is trading around $2,500, reflecting a 6% decrease over the past week.